2025 year in review: How Heron Finance’s private credit strategy performed against industry peers

Since launching our private credit strategy in 2024, we’ve been closely tracking how it performs relative to the broader private credit market. The summary: our approach has delivered stronger performance across returns and key risk metrics compared to a wide range of peers.

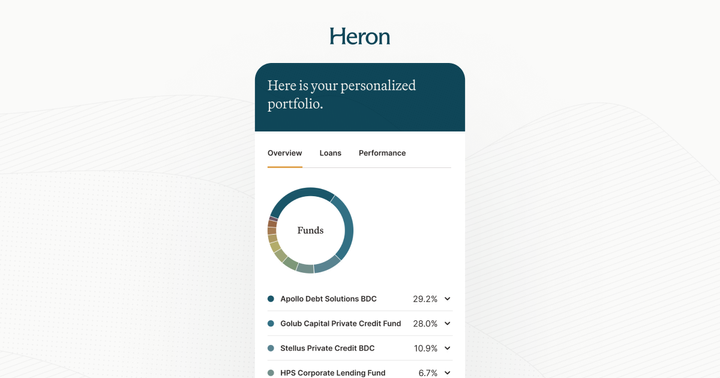

At Heron Finance, we build private credit investing portfolios for accredited individual investors, RIAs, and family offices who want diversified exposure to private markets without having to pick managers or funds on their own.

Heron Finance’s 2025 private credit year in review summary:

- From day one, Heron Finance’s focus has been on thoughtful manager selection and broad diversification.

- Heron Finance uses a proprietary scoring system to rank and select private credit funds.

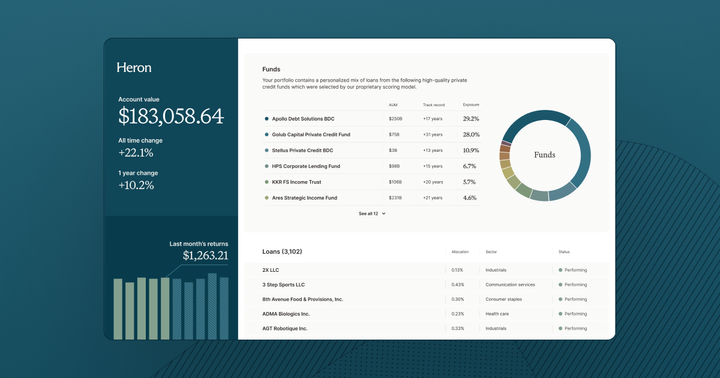

- Private credit strategies at Heron Finance provide investors with exposure to 12 or more experienced private credit fund managers across all 11 GICS sectors, representing more than 3,000 unique loan exposures.

- Heron Finance analyzes 100+ private credit funds, investing platforms, and private credit ETFs to compare performance across the industry.

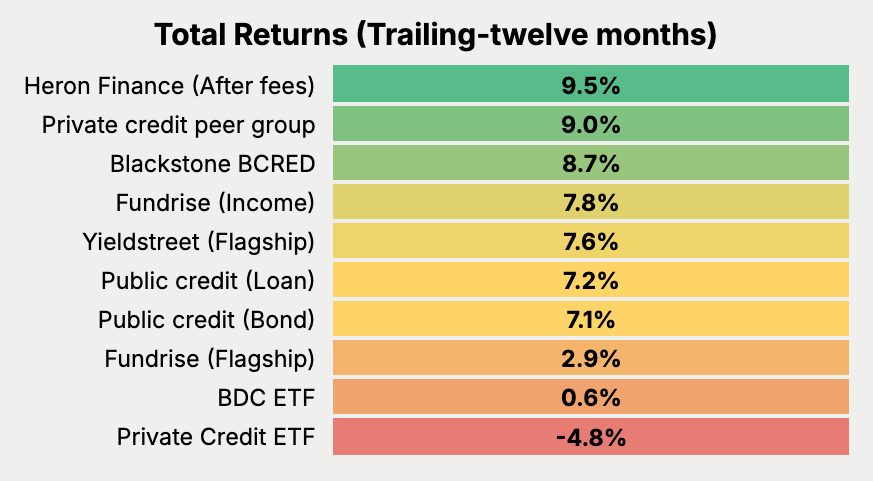

- The funds on Heron Finance have delivered 9.5% total returns (net of Heron’s fees), compared to 9.0% for the peer group (net of fund fees, gross of Heron's fees) over the same period. Additionally, the funds on Heron Finance performed stronger than the peer group across key risk metrics.*

Read on to see how we’ve performed, looking at returns after fees and other key risk metrics.

Get a diversified private markets portfolio built for market volatility.

Private credit returns: Funds on Heron vs private credit market

To analyze how our approach to private credit investing has performed, we compared returns of the funds available on Heron to a wide range of professionally managed funds, ETFs, and digital investing platforms.

You can see, over the past twelve months, the funds we have selected have delivered stronger returns after fees than our competitors. (See Heron’s historical performance.)

Returns shown for trailing 12-month period ending on 9/30/2025 (except for Yieldstreet, shown as of 6/30/2025). Heron Finance return is an annualized return after fees calculated as the weighted average actual returns of all funds available in Heron Finance private credit strategies from September 2024 to September 2025. Peer Group based on average (mean) of 57 comparable funds with returns shown net of fund fees, gross of Heron fees. All other returns shown without deducting 1% Heron fee. Public credit (bond), public credit (loan), Fundrise (flagship), Fundrise (income), Yieldstreet (flagship), BDC ETF, and Private Credit ETF based on total returns of HYG ETF, BKLN ETF, Fundrise Flagship Real Estate Fund, Fundrise Income Real Estate Fund, YieldStreet Alternative Income Fund, Inc., BIZD ETF, and VPC ETF, respectively. Returns shown as total returns based on NAV for Heron, Yieldstreet, BCRED, PC peer group, and Fundrise, and based on market prices for others.

Delivering lower risk and higher returns than our peers

We also analyzed publicly available SEC filings through Q3 2025 (the most recent available data). The comparison includes 69 U.S. private credit funds, managed by firms with over $1 trillion in aggregate private credit AUM. The peer group includes 57 funds within the dataset that are not currently available through Heron’s private credit investing strategy. Heron Finance includes 12 of the funds within the dataset currently available in Heron’s strategy.

Compared to this peer group, the funds within Heron’s private credit have delivered stronger relative results. For the trailing-twelve month period ending in September 2025, Heron compared favorably across key performance metrics versus the broader private credit universe.

Dataset source: SEC filings for September 2025. Dataset includes 69 of the largest U.S. private credit funds (57 of which are the peer group and 12 of which are the funds on Heron), which are actively managed by firms that collectively manage in excess of $1 trillion in private credit assets across their funds and accounts. Heron return is an annualized return after fees calculated as the weighted average actual returns of all funds available in Heron Finance private credit strategies from September 2024 to September 2025. Peer Group based on average (mean) of 57 comparable funds with returns shown net of fund fees, gross of Heron fees. Risk metrics for Heron Finance vs. Peer Group based on average (mean) data. Underperforming Assets based on underlying fund managers’ assessment, shown in terms of fair market value; Loan Valuation based on fair market value divided by amortized cost, shown for first lien loans only; PIK interest shown as payment in kind interest income divided by total investment income; Loan Default based on non-accruals by amortized cost; Loss Rate based on realized investment loss divided by fund net asset value on a trailing four-quarter basis; % First Lien Loans based on first lien loans as percentage of total investments on a cost basis.

We believe these results reinforce the value of our core approach: diversify broadly, partner with experienced managers, and make private credit more accessible through a single, streamlined portfolio.

With this approach, we’ve recently expanded our investment offerings to include diversified exposure to private equity and have plans for additional asset classes in the future. (See how to invest in private equity with Heron Finance.)

How to invest in private credit with Heron Finance

When it comes to private markets, our goal is to automate the complex investment management process for you. Here’s how to invest in private markets with Heron Finance in three steps:

- Get a personalized portfolio recommendation — Complete a quick quiz to assess your risk and return preferences. Heron’s algorithm builds a tailored private credit portfolio by selecting from experienced institutional funds based on rigorous proprietary scoring criteria.

- Fund your investment — Choose a standard or IRA account, transfer funds via ACH or wire, and verify your accredited investor status.

- Start earning passive income — Once invested, you can begin earning income distributions monthly. Your private credit portfolio is automatically optimized over time by Heron’s automated systems.

Get a diversified private markets portfolio built for market volatility.