Everything You Ever Wanted to Know About Alternative Investments

Learn what alternative investments are, the features specific to each investment type, and why private credit is gaining popularity as an alternative to stocks and bonds.

Did you know that approximately 95% of our universe is made up of either dark matter or dark energy?[1] In other words, only about 5% of the known universe has ever been observed by human instruments.

There is a similar dynamic playing out in the financial universe. The average individual investor typically only invests in public markets (stocks and bonds). But public markets only represent roughly 13% of the investable universe–the other 87% is made up of alternative investments.[2]

In this article, we explain what alternative investments are, why they are utilized as part of an investment portfolio, and which one outshines the competition when it comes to the prospect of higher rates of return and lower overall volatility.

Article Highlights

- Traditional investments typically include public stocks, bonds, and cash–every other investment type is considered an alternative investment (popular alternatives include real estate, precious metals, cryptocurrency, private equity, venture capital, and private credit)

- Alternatives are a diverse category–each with their own benefits and risks–but each asset shares commonalities, such as higher potential returns and a lower correlation to equity and bond markets

- Given current market conditions and the emergence of digital platforms that provide access to accredited individual investors, private credit has the potential to outperform other alternatives across key investment metrics

What Are Alternative Investments?

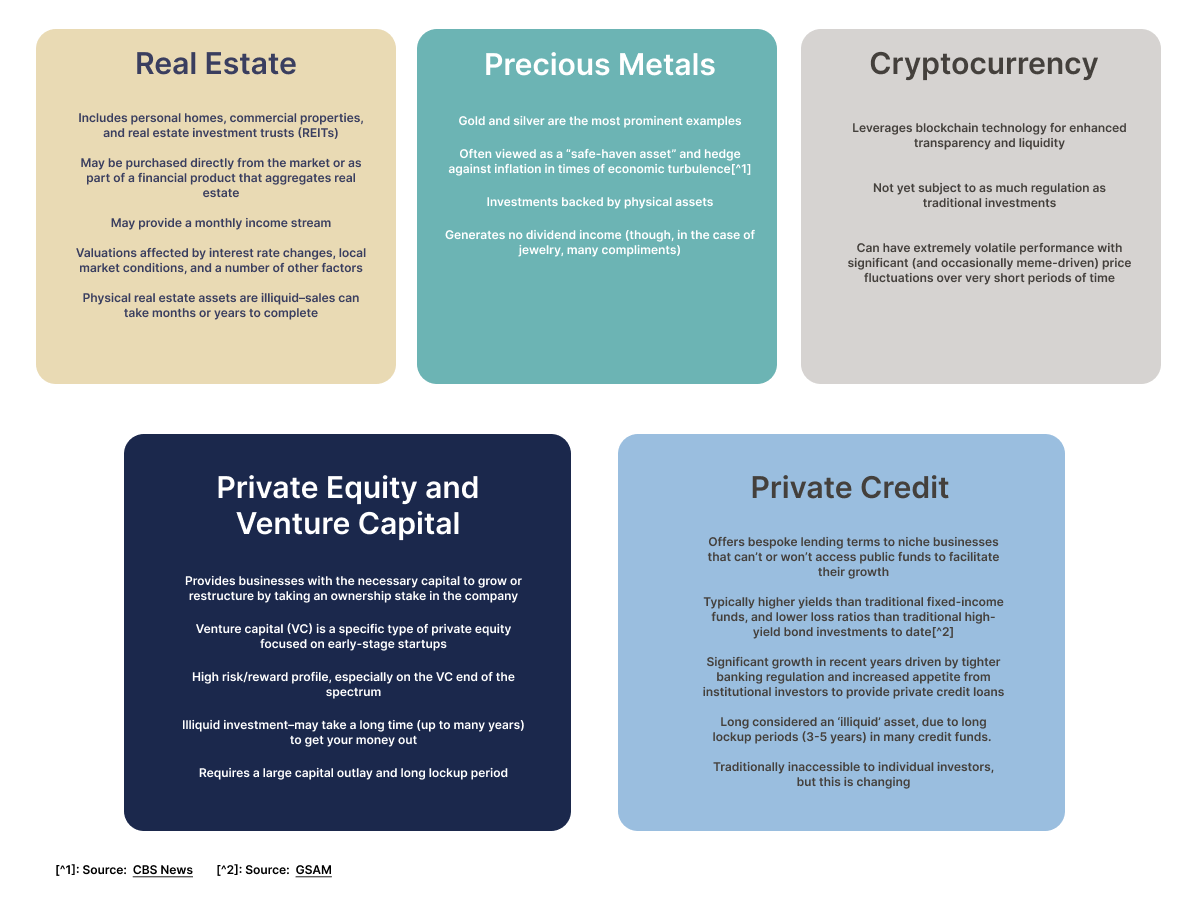

Alternative investments (“Alternatives”) refers to any asset class that is not traditional (stocks, bonds or cash). Think real estate, precious metals, collectibles, cryptocurrency, private equity and private credit.

That’s a diverse array of investment types. Yet alternatives typically share a few key characteristics:

Higher average annualized returns than traditional investments[3]

Lower correlation compared to stocks and bonds, when it comes to macro-economic trends such as inflation and recession (alternatives vary in their degree of correlation)[4]

Some of the most common alternative investments include:

Which Alternative Investment Should You Choose?

‘Alternatives’ is an umbrella term that encompasses a broad and diverse range of investments (not too many similarities between Bitcoin and a rental property in South Florida).

Looking across the spectrum, real estate is the most common investment type, which speaks more to the accessibility and understanding of the asset (you’ve been exposed to real estate since literally the day you were born), than it does to the underlying risk/reward profile.

Private credit offers the prospect of higher returns than stocks with the consistent cash flow of bonds, as well as a low minimum investment requirement.[5] And whereas access was typically restricted to institutional investors, accredited investors can now gain exposure to private credit through platforms like Heron Finance, which allows accredited investors access to pre-vetted private credit deals.

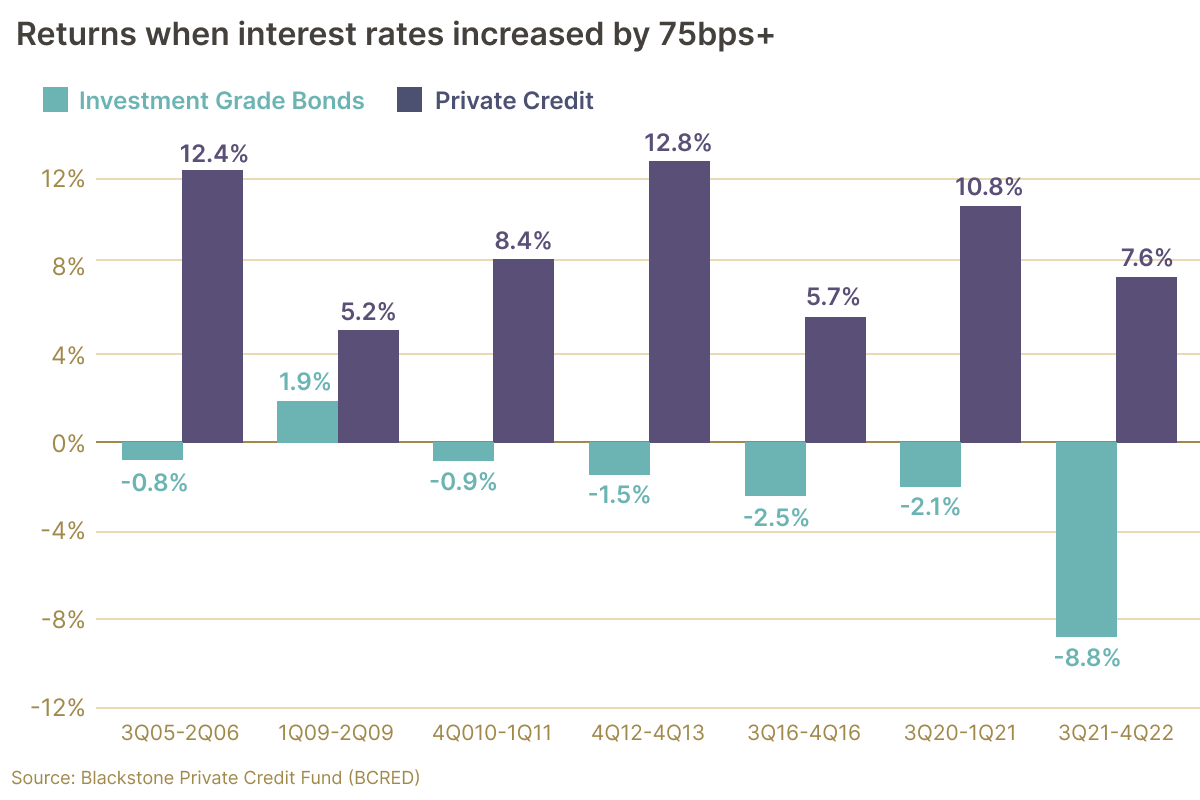

And now is a great time to consider investing in private credit, since it is one of the few asset classes to actually benefit from rising interest rates.[6] This is because private loans are almost always floating rate, which means they rise in concert with the Fed funds rate, offering investors higher returns as interest rates increase.[7]

While past performance is not indicative of future performance, it’s worth taking a look at historical figures:

Source: Blackstone (page 13)

For all of these reasons, private credit stands out as a potentially strong diversification play away from traditional investment types.

Of course it’s worth mentioning that private credit–like all investments–contains risks and drawbacks. Those may include counterparty risk (that the borrower will be unable or unwilling to pay back the loan), interest rate risk (that interest rates will materially increase during the life of the loan–which negatively affects fixed rate loans), and a lack of liquidity (private credit funds traditionally lock up investor capital for several years).

Say Goodbye to the 60/40 Portfolio

Jon Gray, President of Blackstone (the world’s largest private equity firm), recently hailed the current environment as a “golden moment” for private credit.[8] In fact, Blackstone recently raised a $7.1 billion private credit fund–the largest ever in the Energy-transition space.[9]

And that is not an anomaly. Look across the private credit sector, and you’ll find prominent firms like BlackRock, Goldman Sachs, Carlyle, Ares, Oaktree and others announcing massive fundraises.[10] Clearly, the major players appear to believe in private credit’s potential growth story.

Until recently, individual investors looking to gain exposure to this asset class were out of luck. Only institutions could afford to invest in private credit.

But those days are over.

Digital platforms are expanding access to these esoteric investment types. Now, US accredited investors can access private credit deals, and may do so at a time when institutions are investing heavily in the sector.[11]

If you’re looking to diversify away from traditional investments and gain exposure to alternatives, it's worth taking a deeper dive into the possibilities offered by private credit. You can learn more about the asset class here.

And to quickly stay on top of private credit news and current events, subscribe to our Private Credit Newsletter.

Source: Hamilton Lane ↩︎

Source: NYU Stern, data from Preqin ↩︎

Source: Blackstone ↩︎

Source: Blackstone ↩︎

Source: Blackstone ↩︎