How to Invest in Private Credit

Learn what private credit is, how it works, its diversification benefits, and how retail investors can participate in this asset class.

Imagine the possibility of being able to achieve better annual returns than stocks, with the consistency of bonds.

Sounds impossible, right?

Over the last 30+ years, private credit investment in the U.S. has had double-digit annualized returns, soundly beating the S&P 500 over that time[1]. Private credit has also produced steady cash flow and more consistent returns historically, relative to both stocks and bonds[2] (with the important caveat that past performance is not indicative of future performance).

So what’s the catch? Well, there are a couple, actually:

- Traditionally, private credit has been the purview of institutional and high net worth (HNW) investors. Until recently, accredited investors could not access private credit deals without a significant capital investment

- Private credit is generally illiquid (investors typically must keep their money invested for many years). Since institutional and HNW investors are less likely to need their capital back in the short term, long lockup periods are usually a feature of this asset class

But a revolution is afoot.

Digital platforms are innovating the private credit landscape, enabling accredited investors to access these investments. And in an effort to court accredited investors, these same digital platforms are adapting the private credit model by dramatically shortening lockup periods (more on that below).

So let’s shine a light on this rather opaque asset class.

Key Takeaways:

1. Private credit is any non-bank loan where the debt is not issued or traded on public exchanges (technically, banks can issue private credit loans by launching specialized private credit funds, but these operate as separate investment vehicles)

2. Some of the key terms in private credit deals are the loan amount, the interest rate, repayment schedule, and maturity date (i.e. when the loan should be fully repaid)

3. Unlike most other asset classes, private credit has thus far had a consistent track record of high returns and low volatility (though it’s worth noting that rising default rates can trigger volatility). Despite these benefits, large capital commitments and long lockup periods have dissuaded many retail investors from participating

4. Thanks to digital innovation, accredited investors now have the possibility to gain exposure to private credit with limited capital investment and much shorter lockup periods than has traditionally been available

What is Private Credit Investing?

Private credit may be private in principle, but in practice, it’s everywhere. And similar to other asset classes, private credit has its own potential benefits and risks, which are elaborated on below.

Any non-bank loan that takes place outside of the public markets is considered private credit–from a business securing a $1 billion funding facility to your best friend lending you $10. Each of these examples is considered private credit, so long as the transaction does not take place in the public markets.

At its most basic level, private credit allows investors to provide capital (principal) to a business, in exchange for regular cash payouts (interest) and the recoupment of said principal after a set period of time (maturity date).

While individuals lending money to one another is a form of private credit (peer-to-peer lending), for the purpose of this article, we’re focusing on the commercial lending side of private credit (business loans).

Commercial lending contains a vast universe of transactions: from micro-loans of a few thousand dollars to small businesses in emerging markets, to large-cap multi-billion dollar loans like Finastra Holdings’ recent $5.3 billion restructuring loan, the largest ever private credit transaction[3].

How Does Private Credit Work?

Let’s say a furniture manufacturer needs $1 million. Maybe they want to hire more workers, generate more inventory, do some marketing, or acquire a competitor. Whatever the reason, the business needs additional capital that it doesn't currently have.

Assuming they don’t want to issue equity and give up an ownership stake in the business, they can opt to take out a $1 million loan with the promise to repay it at a future date, while making regular interest payments along the way.

Publicly-traded companies have the option of issuing debt on the public markets in the form of bonds, which can be purchased by the general public. Yet private businesses don’t have that luxury, which means they must turn to the private credit market to obtain loans (side note: public companies can also obtain private credit. Confusing, right? A public company can (and do) eschew the public market and raise capital from a private lender in certain situations).

When companies approach the private credit market, they typically obtain a loan from a private lender–a bank or credit fund that makes such loans. The lender will roll up its sleeves and perform due diligence on the underlying business, financials, management team, industry, market dynamics, and any other pertinent information.

Essentially, the lender wants to know two things: Will the borrower be able to make the interest payments on time, and will I get my money back?

Sounds simple, but in reality, the above consideration gives way to a whole host of questions, including:

- Where am I in the capital stack (if the borrower defaults and assets are liquidated, when do I start to receive money back vis-a-vis other lenders and equity owners)?

- What collateral is the borrower using to secure the loan, and what is the value of that collateral?

- What exactly can the loan be used for?

- What financial metrics must the company maintain to remain in good standing?

- How easily can the lender enforce its claim if a borrower defaults?

There is a lot to consider here: the risk of default, the repayment process, the valuation of collateral, legal enforcement of a credit agreement, and so on.

To formalize their downside protection, lenders often include legal protections and borrower conditions in their credit agreements, known as covenants. Covenants can be financial (borrower must maintain a certain debt-to-equity ratio), or behavioral (borrower must submit quarterly financials for review, or must not engage in certain business activities during the lifetime of the loan).

If a borrower breaches a covenant, lenders have the right to call back their principal investment subject to the terms of the loan agreement. If the borrower cannot pay back that principal, a default occurs, and the lender may take ownership of the collateral.

Lenders don’t always want this. They are not in the business of taking ownership of assets and then finding ways to liquidate those assets. Lenders are in the business of issuing loans, so they will often work with borrowers to negotiate covenant breaches by restructuring the loan agreement (often at a cost to the borrower in the form of additional fees).

Assuming the lender performs its due diligence on the borrower and likes what it sees, the lender will then issue a term sheet: a proposal to lend a certain amount of capital at a set interest rate, for a specific duration of time.

Often, borrowers will shop around with multiple lenders, and select what they believe to be the best term sheet (interest rate is one of the main factors, but covenants and lender relationships also come into play). Once that happens, a credit agreement is signed by both parties, and a private credit transaction is initiated.

Diversifying Your Portfolio with Private Credit

Now that you know how private credit works, you might be wondering why it has the potential to make such a strong investment.

The three short answers are that it can produce:

The proposed benefits of the first two are clear: Higher returns would be, well…higher. And private credit–like bonds–offers the possibility of consistent cash flow as borrowers pay the interest on their loans.

Of course it’s worth pointing out that private credit also contains risks and drawbacks, including counterparty risk (that the borrower will be unable or unwilling to pay back the loan), interest rate risk (that interest rates will materially increase during the life of the loan–which negatively affects fixed rate loans), and a lack of liquidity (private credit funds traditionally lock up investor capital for several years).

In terms of diversification, while some might claim that holding a stock market index fund counts as a diversified portfolio, true diversification comes from investing across many asset classes. To wit, top asset managers like BlackRock and KKR recommend allocating 10-20% of their clients’ portfolios to private credit. Think of private credit as a potential anchor in your portfolio–its tendency for low volatility and lack of correlation with the stock market can make it a grounding force[6].

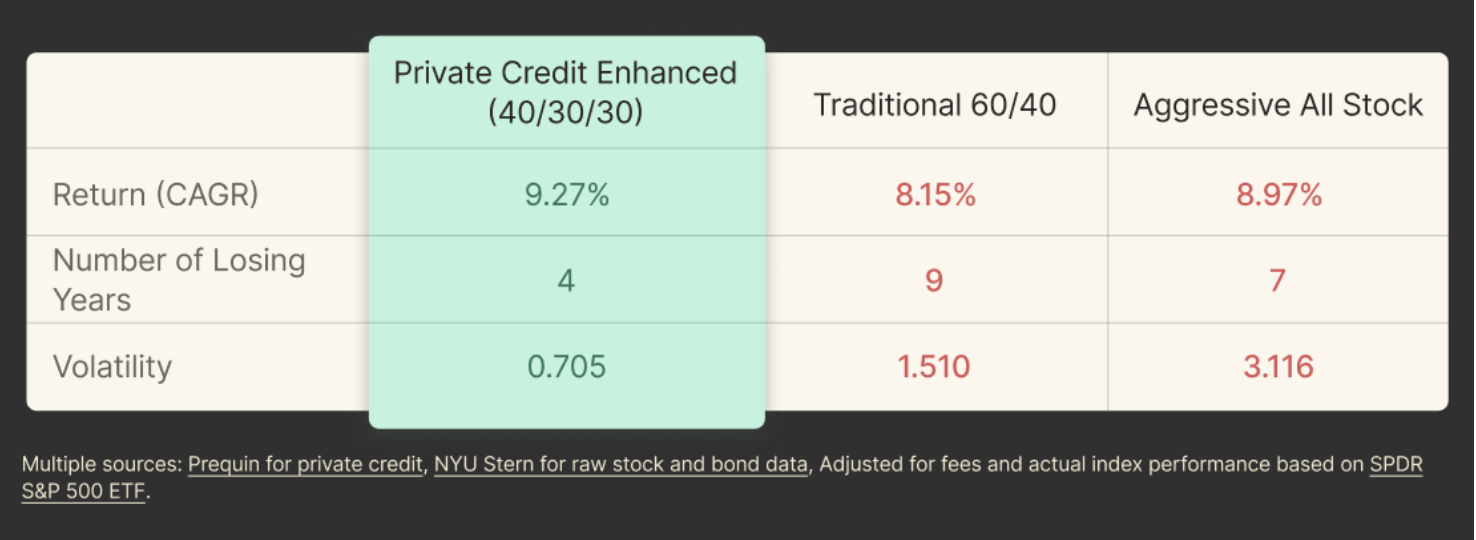

Even though past performance is not indicative of future results, the past 30 years can provide a useful measure for consideration. Just look at how investment portfolios with private credit exposure have fared vs. traditional 60/40 and aggressive all-stock portfolios over the last 30 years:

Source: NYU Stern, data from Preqin

As the chart above illustrates, portfolios with even a moderate amount of private credit exposure experienced higher overall returns (inclusive of fees), and much lower volatility than traditional 60/40 or all-stock portfolios. Although there can be no certainty that this trend will continue, the chart above is a useful tool when considering how private credit may help diversify a portfolio.

Digital Disruption in Private Credit: Expanded Access and Enhanced Liquidity

It’s time to circle all the way back to the caveats we mentioned at the outset of this article.

Private credit offers the possibility of high returns and low volatility, but has traditionally been off-limits for many retail investors. Because of that, private credit investors have typically had to sacrifice liquidity in the form of long lockup periods, in order to gain exposure to this enviable asset class.

But things are changing.

Digital technology is paving the way for accredited investors to participate in the private credit marketplace. Platforms like Heron Finance make it easier to invest in global private credit deals by offering accredited investors access without any minimum investment requirement.

And as more investors enter the space, the features of the asset class are adapting to meet their needs. Accredited investors are more sensitive to longer lockup periods than their institutional and high net worth counterparts, which is why Heron Finance is targeting shorter liquidity than the standard 3-5 years of a traditional private credit fund.

And this is all coming at what may be the perfect time for investors. The private credit asset class seems to be experiencing a ‘golden moment’, thanks to banking regulation in the wake of The Great Recession that forces large banks to maintain lower debt-to-equity ratios than in previous years, which means they can issue fewer loans[7]. The deals that they would otherwise finance are now moving downstream to private credit funds, which can issue more favorable credit terms to borrowers as demand outstrips supply.

Additionally, rising interest rates are good news for private credit investors, because unlike bonds, most private credit loans are floating-rate, which means when interest rates rise, the interest payments that borrowers make rise in tandem[8].

Putting it All Together

Private credit has a superpower: the possibility of stock-like returns with bond-like consistency. Returns are typically less correlated with public markets than most other asset classes, making private credit an attractive diversifier, which has thus far outperformed even aggressive all-stock portfolios over the past 30 years.

Traditionally, private credit investments were difficult to access and contained long lockup periods. But digital platforms like Heron Finance are bringing private credit to the general public, making it easy to invest alongside institutions and HNW investors.

And now is a great time to consider gaining exposure to this asset class, given the myriad of tailwinds at play.

If you’re considering investing in private credit, it’s worth staying on top of the latest news and current events by signing up to our Private Credit Newsletter.

Source: NYU Stern, data from Preqin ↩︎

Source: NYU Stern, data from Preqin ↩︎

Source: NYU Stern, data from Preqin ↩︎

Source: NYU Stern, data from Preqin ↩︎

Source: Cleveland Fed ↩︎