Monthly insights: The case for private equity (November 2025)

We share five charts that show why private equity has the potential to help accredited investors diversify their portfolios beyond public markets.

Special Issue: Monthly Insights #8, November 2025

In this issue:

- Special issue: The case for private equity

- Fund facts: Over 30 years of experience

- Quote of the month: Your ‘risk muscle’

Special issue: The case for private equity

We recently launched our new Private Equity strategy, giving you exposure to over 7,000 portfolio companies with funds from managers like Carlyle. (Learn about the Private Equity strategy.)

In this Monthly Insights issue, we share five charts to help explain our view on why private equity has the potential to help accredited investors diversify their portfolios beyond public markets.

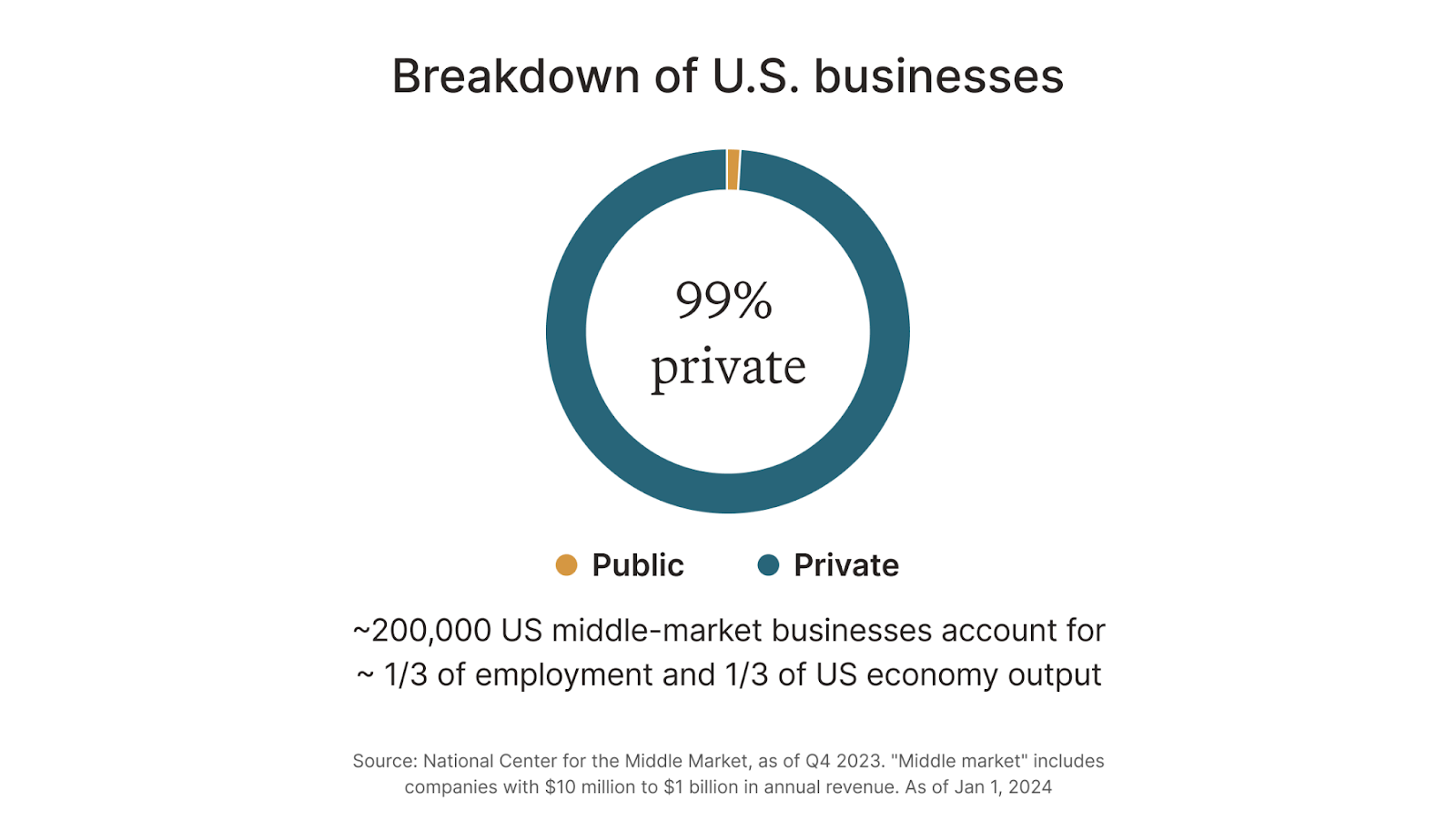

Chart 1: 99% of businesses are private

Private equity provides an opportunity to diversify that the stock market simply can’t. In fact, the stock market is increasingly more concentrated, with about 40% of the S&P 500’s total market capitalization made up of just 10 companies. Approximately 99% of U.S. businesses are privately held, and at the heart of this are roughly 200,000 middle-market companies. Together, these firms generate about one-third of all U.S. employment and roughly one-third of total economic output.

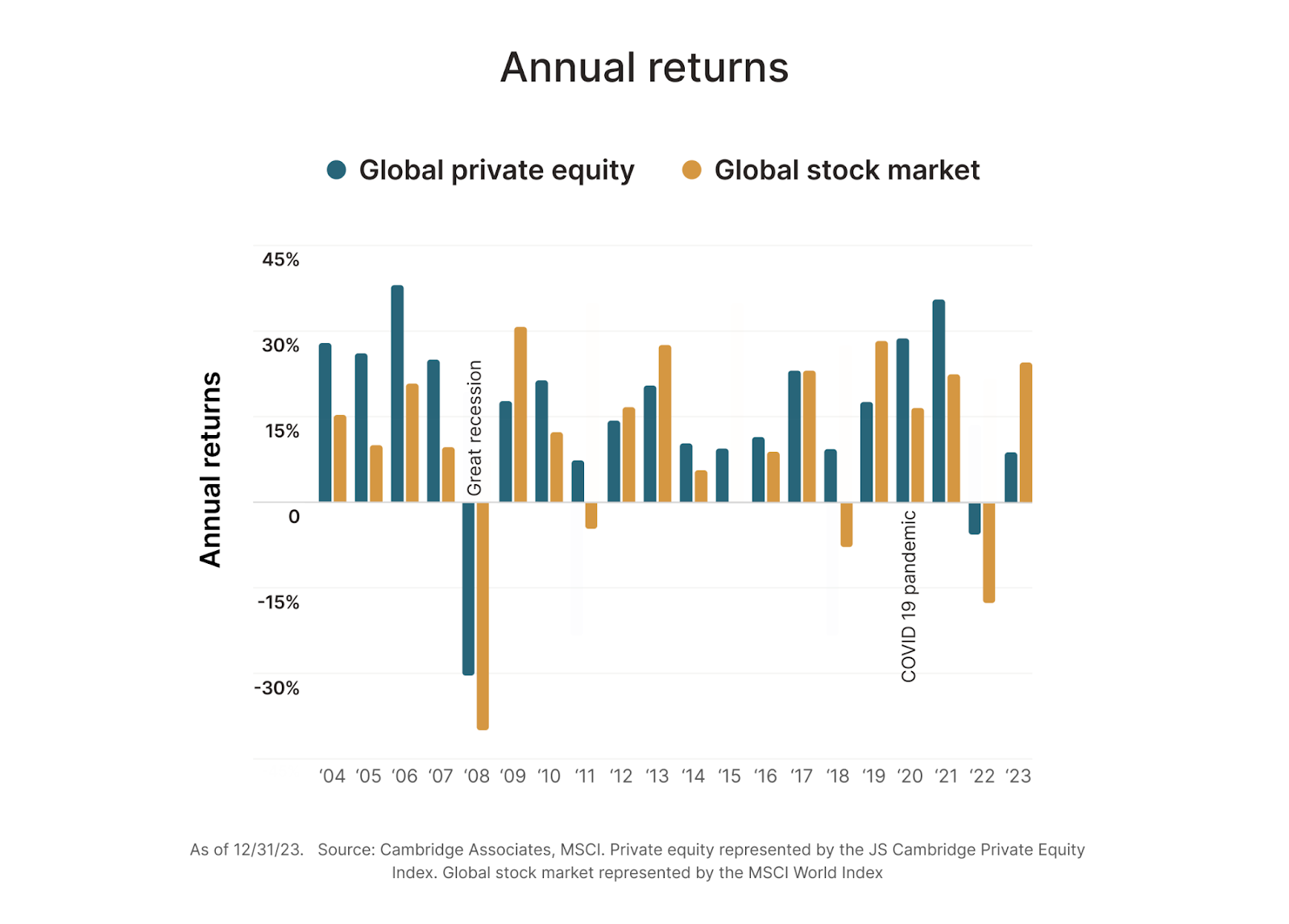

Chart 2: Private equity annual returns

Over the past 20 years, private equity has outperformed stocks in 15 years. And private equity has only had two down years compared to stocks with four negative return years. Additionally, during the two negative years for private equity, the drawdowns in the stock market were more severe.

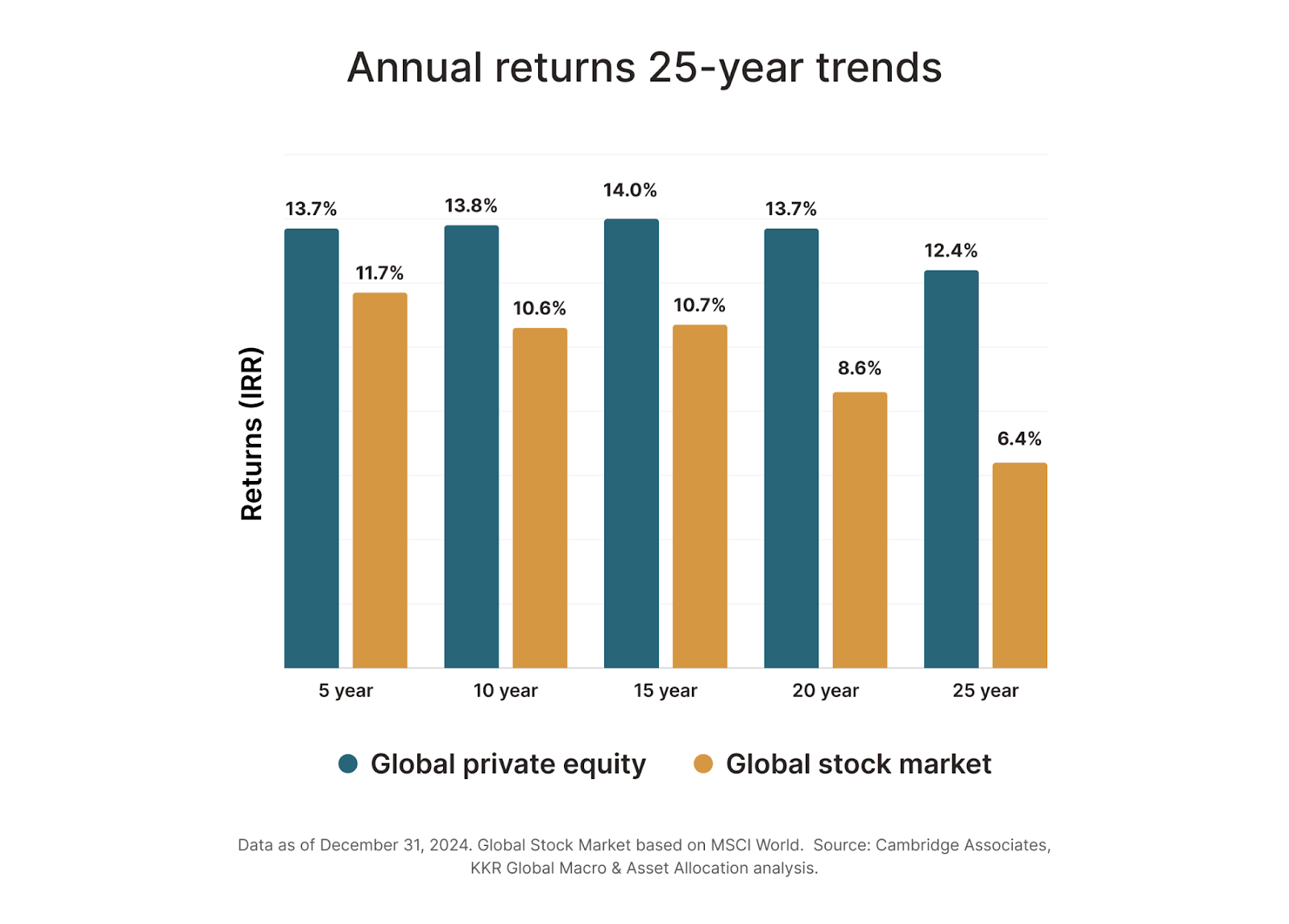

Chart 3: Private equity’s long-term historical returns

Over the past 25-year period, ending on December 31, 2024, private equity has almost doubled global stock market returns, and has historically outperformed the stock market across time periods.

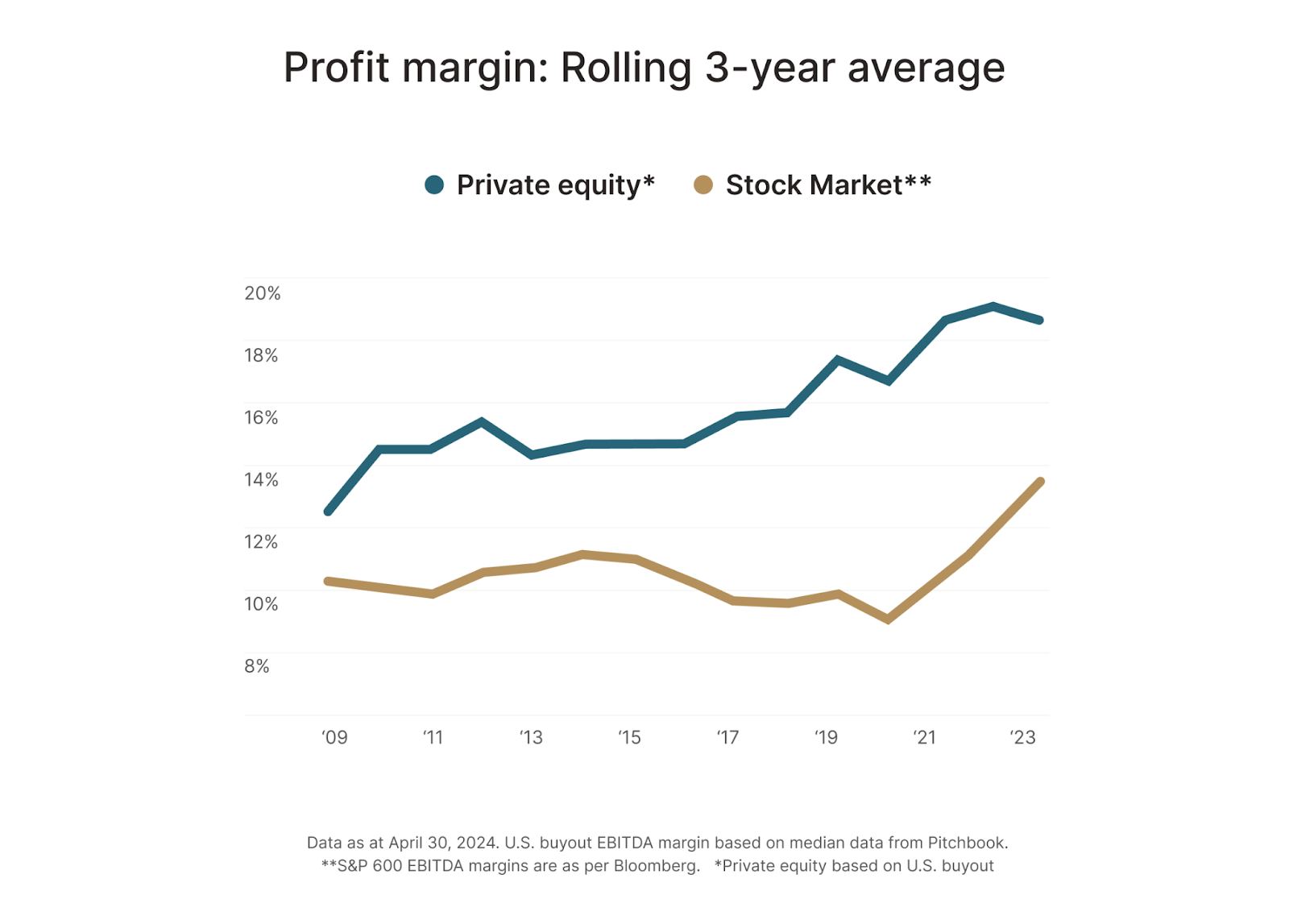

Chart 4: Private equity-backed company profit margin

Private equity-backed companies have the potential to deliver investors returns via higher profit margins. Private equity-backed firms have historically shown profit margins of around 2-4% higher than public companies.

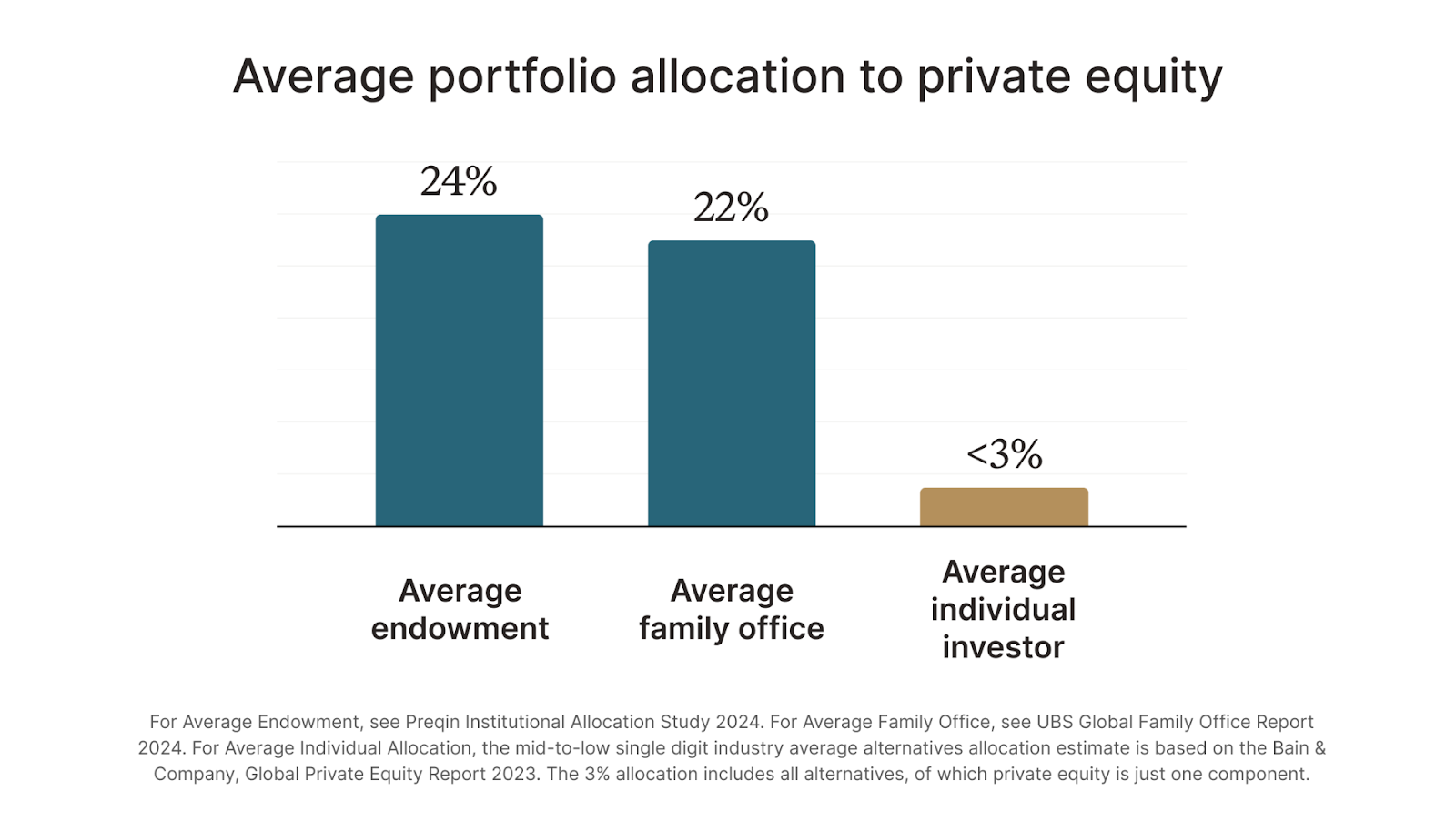

Chart 5: Institutional allocation

Recent estimates from Preqin, UBS, and Bain & Company show that institutions allocate far more of their portfolio into private equity. Generally, the key reasons for such under-allocation to private equity by individual investors have been lack of access, high minimum investments, multi-year lockup periods, and cash drag due to capital calls in traditional private equity fund structures. Now, at Heron we make investing in private equity easier for individual accredited investors.

What does it mean for Heron investors?

Private equity provides the potential for long-term returns that have historically outpaced global stocks. As we expand our platform here at Heron, accredited investors will now have access to private equity assets that institutional investors have long been investing in.

The team at Heron is excited to continue to expand our private markets solutions to help you build a diversified portfolio and navigate market volatility.

As always, thanks for reading,

Heron Chief Credit Officer

Heron fund facts

Fact: The average private equity management experience is 30-plus years for the managers that we feature in the new Heron Private Equity strategy.

Why that matters: The experience of the fund managers you invest in can be one of the most important factors when mitigating risk. At Heron, we look for managers who have been successful navigating market cycles, including the 2008 crisis and COVID.

Quote of the month

“Everyone has a 'risk muscle.' You keep it in shape by trying new things. If you don't, it atrophies. Make a point of using it at least once a day.”

– Roger von Oech

Get a diversified portfolio built for market volatility.

Disclaimer: Private equity investments involve a high degree of risk, including the potential loss of the entire investment, illiquidity, long holding periods, limited transparency, and sensitivity to economic and market conditions. Diversification does not ensure a profit or protect against loss, and past performance is not indicative of future results. Comparisons to individual private funds, public markets, institutional portfolios, or other benchmarks are provided for illustrative purposes only. These may not represent a direct comparison, may rely on data reported by third-party managers, and may reflect differing methodologies, time periods, or investment universes. Data from underlying fund managers may be subject to reporting lag, estimation, or revision.