Private Credit's Uncertainty Principle

Learn why macroeconomic uncertainty may actually be a good thing for private credit investors.

In October of 2022, Bloomberg opined that there was a 100% probability of a recession happening within 12 months.[1] In November, the Economist stated that “a global recession is inevitable in 2023."[2] And yet here we are in 2024, with no recession to speak of.

What the heck happened?

The short answer is: The US economy proved much more resilient than expected.

Many anticipated that the Federal Reserve’s record-breaking pace of interest rate hikes in response to elevated inflation would trigger a recession,[3] yet consumer spending has remained robust–due in part to three rounds of pandemic-era stimulus checks), and the job market has remained strong.[4]

So our little $27 trillion economy may not be as fragile as many commentators predicted. All of that said, we are still teetering on the brink of a recession–with 2024 bearing the possibilities of a ‘soft landing’ (no recession), a mild recession, or even a massive, Great Recession-style crisis.

In short, this is a moment of economic uncertainty.

When They Go Low, We Go High

Historically, private credit has displayed consistent performance and resilience during times of economic uncertainty and traditional market volatility.

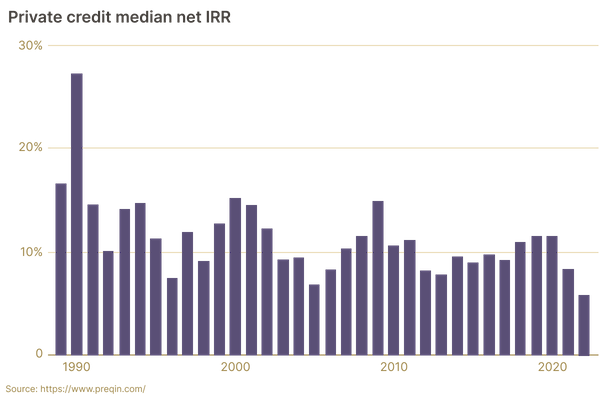

The first below chart shows private credit’s performance during times of interest rate spikes (note the comparison with investment grade bonds), and the second chart illustrates the median private credit fund manager’s performance over the past 30+ years (note not a single down year).

Source: Blackstone, Source: data from Preqin

This underscores our general thesis that private credit is a worthwhile asset class to consider during times of economic uncertainty. The consistent return profile relative to that of public markets (both stocks and bonds have had plenty of down years recently), coupled with the fact that private credit performs well during times of rising interest rates (unlike other alternative assets, such as real estate), make this an attractive option for investors looking to diversify their portfolios.

The Best of Times, the Worst of Times

As far as what happens to our economy in 2024, let’s take the best case scenario–that inflation continues to decelerate and the Fed subsequently lowers interest rates, and we (some might say miraculously) avoid a recession.

Where does private credit stand vis-a-vis other asset classes?

Well, in such a scenario, the corporate default rate–the percentage of U.S. companies that default on their loan obligations–likely decreases. That’s great news for private credit, since the #1 concern for private credit investors is: Will I get my money back? In a corporate default, private credit lenders may lose some or all of their investment.

It’s worth pointing out that the current U.S. default rate of 4.1% is in-line with the 4% rate of the mid-1990's–the last time the U.S. experienced a so-called ‘soft landing.’[5] Should the Fed engineer another soft landing and avoid a recession, we might see default rates peak at this level and come down to the optimistic level of ~3% by the end of the year.[6]

Of course, other asset classes–like stocks and real estate–will likely surge in value should the U.S. avoid a recession. So it’s difficult to say how private credit will fare against other asset classes in a best case scenario, though we can surmise that private credit itself will likely produce positive returns.

Now for the worst case scenario–let’s imagine the Fed does indeed trigger a recession, and it’s an impactful one. Interest rates remain high, stocks are slammed, real estate values plummet, and corporate default rates skyrocket to above 5%.

Now where does private credit stand vis-a-vis other asset classes?

Well, such a scenario is a mixed bag for private credit investors–remember, this asset class performs well during times of high interest rates (many private credit loans are floating rate, hence they are pegged to the benchmark interest rate). That said, rising corporate defaults increase the probability of losses being realized in private credit investments.

So there are positive and negative indicators. However, if we return to the chart above, which illustrates private credit’s performance over the past 30+ years, we can see that the median fund manager did not experience a single down year–even during The Great Recession.

Even though past performance is not an indicator of future performance, we at Heron Finance are operating under the assumption that private credit will continue to perform well should a worst case scenario emerge.

To Summarize: If the economy improves, that’s good news for private credit (though it’s also good news for most other asset classes). Should the economy worsen, that is mixed news for private credit (and bad news for most other asset classes).

Bottoms Up

At Heron Finance, we conduct a ‘bottom-up’ analysis of each deal we come across.

In plain English, that means we evaluate each deal on its own merit, vs. building a portfolio around certain macroeconomic assumptions.

This bottom-up approach affords us greater flexibility when making investment decisions, as it precludes a bias towards a given industry, company size, or geographic location. It also means we underwrite to recession-level default rates–that’s a fancy way of saying that we can assume the worst in our underwriting standards, and allocate capital to businesses we feel are more recession-resistant, while also diversifying our slate of portfolio companies.

Of course, we’re hopeful the economy remains resilient throughout the rest of the year, and that the Fed can engineer a soft landing. But let’s remember the lesson of 2023: No one has a crystal ball. Bloomberg’s “100% probability of a recession” prediction turned out to be 100% wrong.

So we always take a 'bottom-up' approach, regardless of what the pundits or indicators are saying–this helps us remain cautious and humble about the future.