Why invest in private infrastructure in 2026? 3 charts for investors

Explore three charts that explain how private infrastructure investing may be a strategic addition to an investor’s larger portfolio.

Private infrastructure offers exposure to assets that underpin essential economic activity.

Historically, the asset class has shown resilience during periods of elevated inflation and market stress. Longer term, rising energy consumption and expanding data-center needs—driven in part by AI adoption—are expected to support ongoing infrastructure investment.

Below, we make the case for investing in private infrastructure funds by looking at three charts that explain how private infrastructure investing may be a strategic addition to an investor’s larger portfolio.

See how to invest in private infrastructure and gain exposure to 5 experienced fund managers and over 1,000 assets with a Heron Finance portfolio.

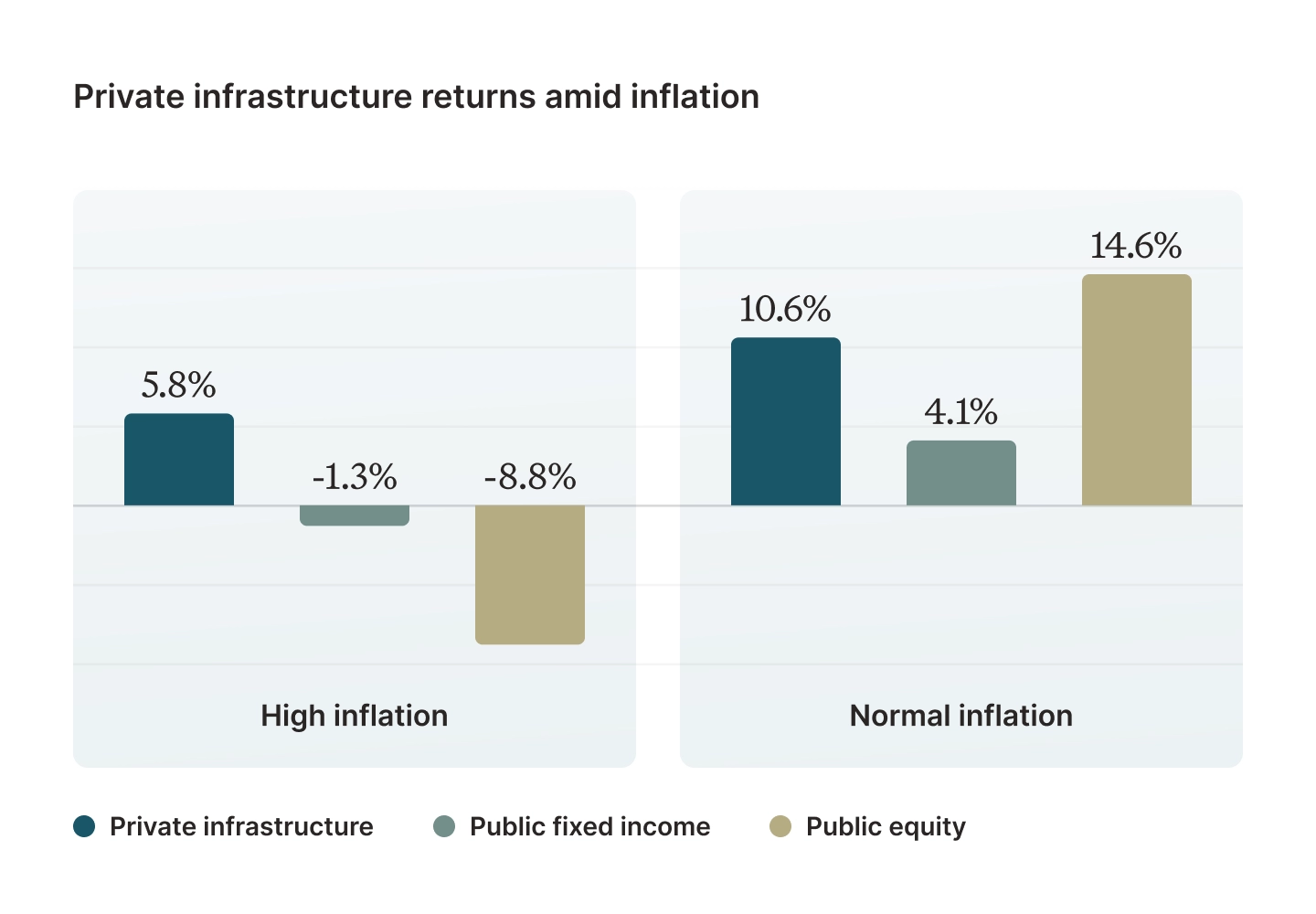

Chart 1: Private infrastructure can be a hedge against inflation

Private infrastructure has outperformed stocks and bonds during past periods of elevated inflation.1

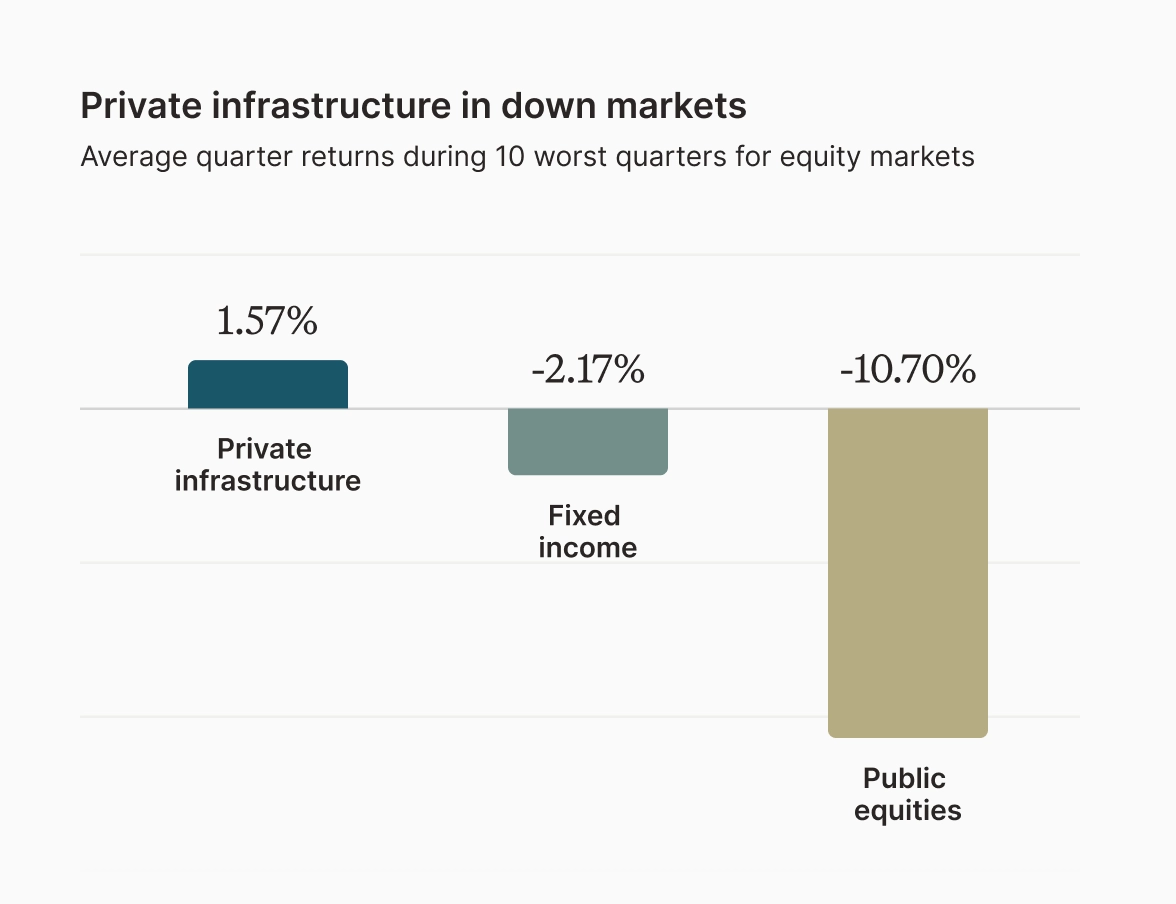

Chart 2: Private infrastructure historically offers strong performance during downturns

Historically, private infrastructure has maintained positive performance in market downturns.2

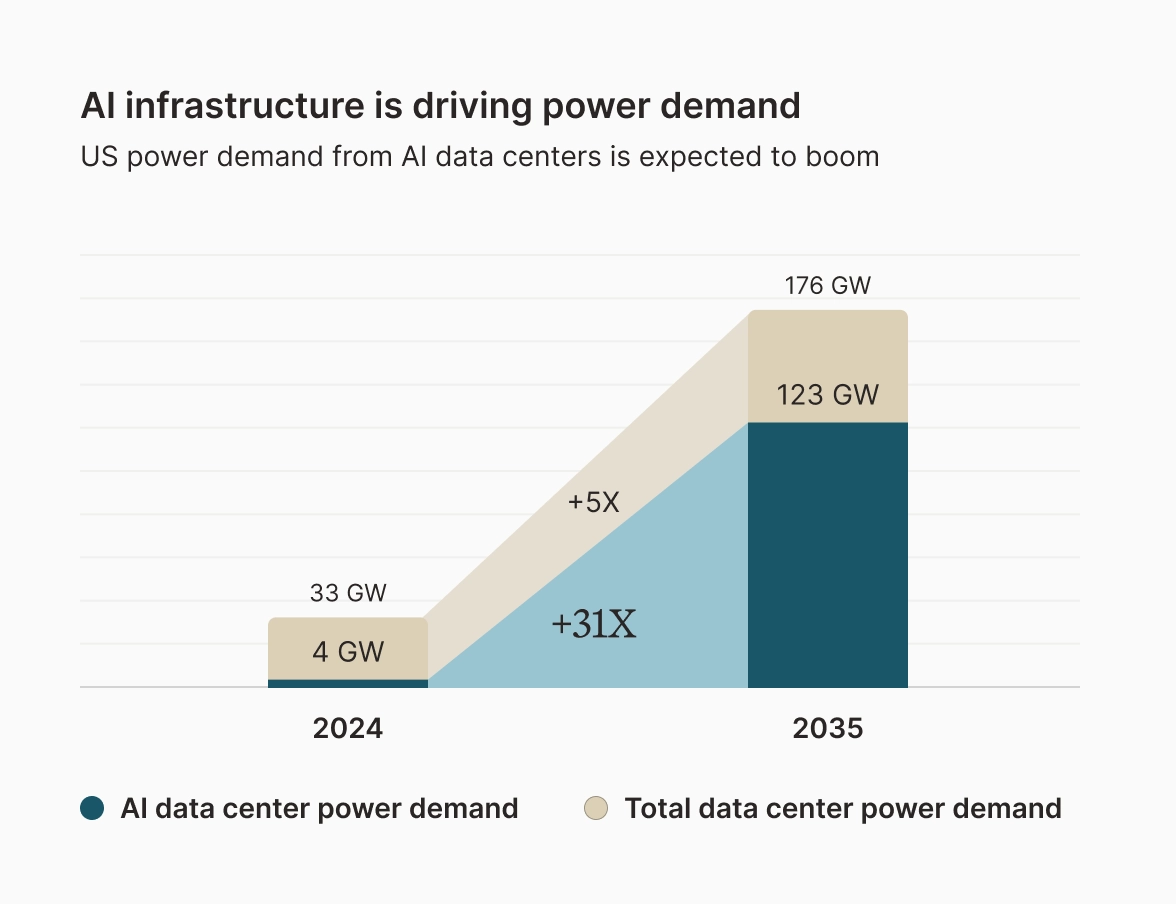

Chart 3: Private infrastructure is positioned well for AI-driven growth

Looking forward, AI is driving immense demand for energy consumption and data centers.3

Hedge against inflation and market volatility with experienced private infrastructure funds. Gain exposure to 1,000+ assets with Heron's globally diversified private infrastructure strategy.

Private infrastructure investing FAQs

The following are common questions investors may have about investing in private infrastructure.

What is private infrastructure?

Private infrastructure is an investment category focused on privately owned, long-lived physical assets that provide essential services to the economy and society—such as energy generation and transmission, utilities, transportation networks, data centers, and communications infrastructure. These assets are typically held through private funds or direct ownership rather than public stock markets, and they are valued based on underlying cash flows and long-term contracts. Investors often use private infrastructure to seek durable income, diversification from public equities, and exposure to assets supported by long-term demand trends.

What are private infrastructure funds or “infra” funds?

Private infrastructure funds—often called “infra” funds—are private investment vehicles that pool capital to acquire, develop, and operate essential infrastructure assets such as energy systems, utilities, transportation networks, data centers, and communications infrastructure. These funds typically invest with a long-term horizon and seek returns driven by contracted or regulated cash flows rather than public market trading. Infra funds are commonly used by institutional and high-net-worth investors to gain exposure to real assets that support core economic activity, while accepting trade-offs such as reduced liquidity, longer lockups, and less frequent valuations.

What is the difference between listed infrastructure and private infrastructure?

Listed infrastructure consists of publicly traded companies—such as utilities, energy pipelines, and transportation operators—whose shares trade on stock exchanges and tend to move with broader equity markets due to daily pricing and investor sentiment. Private infrastructure, by contrast, involves direct investments in infrastructure assets or private funds that own and operate them, with valuations typically based on underlying cash flows rather than market trading. As a result, private infrastructure often exhibits lower reported volatility and different return drivers than listed infrastructure, while also involving longer holding periods, reduced liquidity, and less frequent pricing.

How can individuals invest in private infrastructure funds?

Individuals can invest in private infrastructure through several avenues, including institutional private infrastructure funds (often accessed via financial advisors), direct investments alongside developers or operators, feeder funds, and select interval or tender-offer funds that provide limited liquidity. In addition to these options, platforms like Heron Finance offer a streamlined way for accredited individuals and family offices to access diversified private infrastructure strategies with exposure to multiple professionally managed funds through a single investment. Investors can learn more about Heron’s private infrastructure approach at heronfinance.com/private-infrastructure.

Hedge against inflation and market volatility with experienced private infrastructure funds. Gain exposure to 1,000+ assets with Heron's globally diversified private infrastructure strategy.

Private infrastructure investments involve a high degree of risk, including the potential loss of the entire investment, illiquidity, long holding periods, limited transparency, and sensitivity to economic and market conditions. Diversification does not ensure a profit or protect against loss, and past performance is not indicative of future results. Data from underlying fund managers may be subject to reporting lag, estimation, or revision.

Sources:

1 All data is quarterly and represents the 20-year period from Jun 2004 - Jun 2024. High inflation determined by the 80th percentile of CPI over the same period. Normal inflation determined by periods when CPI was less than the 80th percentile. Private infrastructure represented by Burgiss All Infrastructure Index. Public equity represented by MSCI World Index. Public fixed income represented by Bloomberg Global High Yield Bond Index. Past performance is not an indicator of future returns. For original, see:https://www.areswms.com/accessares/private-market-insights/private-infrastructure-investing-tomorrow-looking-after-your

2 Ten worst quarters tracked for the period January 1, 2010 through December 31, 2024. Source: Bloomberg; Preqin. Equities refers to MSCI World Index; Fixed Income refers to the Bloomberg Global Aggregate Index; Private Infrastructure refers to the Preqin Infrastructure Index. For original, see: https://www.brookfieldoaktree.com/sites/default/files/funds/tender-offer-funds/brookfield-infrastructure-income-fund-presentation.pdf

3 Deloitte analysis of data from DC Byte, Wood Mackenzie, S&P Global, Lawrence Berkeley National Laboratory, Center for Strategic and International Studies, and Wells Fargo. For original, see: https://www.deloitte.com/us/en/insights/industry/power-and-utilities/data-center-infrastructure-artificial-intelligence.html