Announcing the Launch of Heron Finance

Heron Finance is the first robo-advisor focused exclusively on private credit.

We are thrilled to announce the launch of Heron Finance, the first robo-advisor focused exclusively on private credit.

Heron Finance offers U.S. accredited investors access to the burgeoning private credit asset class, which has long been an attractive asset class for institutions and high net-worth individuals (“HNWI”). Heron Finance is expanding access to private credit by allowing accredited investors to build an automated portfolio of private credit deals.

Accredited investors can join the platform’s waitlist here.

For too long, access to private credit has been limited to HNWIs, and investment opportunities have typically had high minimum investments (often $250k+), with multi-year lockups. Heron Finance is here to change that by offering clients no lockup periods, enhanced liquidity, and increased financial transparency.

But let’s take a step back and explore why we’re excited to provide access to private credit in the first place, and why we believe blockchain technology can help usher in a brighter economic future for all investors.

The Decline of Bank Lending and the Rise of Private Credit

Traditionally, private credit investment has been reserved for institutional and HNWI investors, thanks to the high minimum investments that are typically necessary to participate. As a result, accredited investors who were not HNWIs often missed out on private credit opportunities that provided attractive returns relative to stocks, and payment streams similar to fixed income investments.

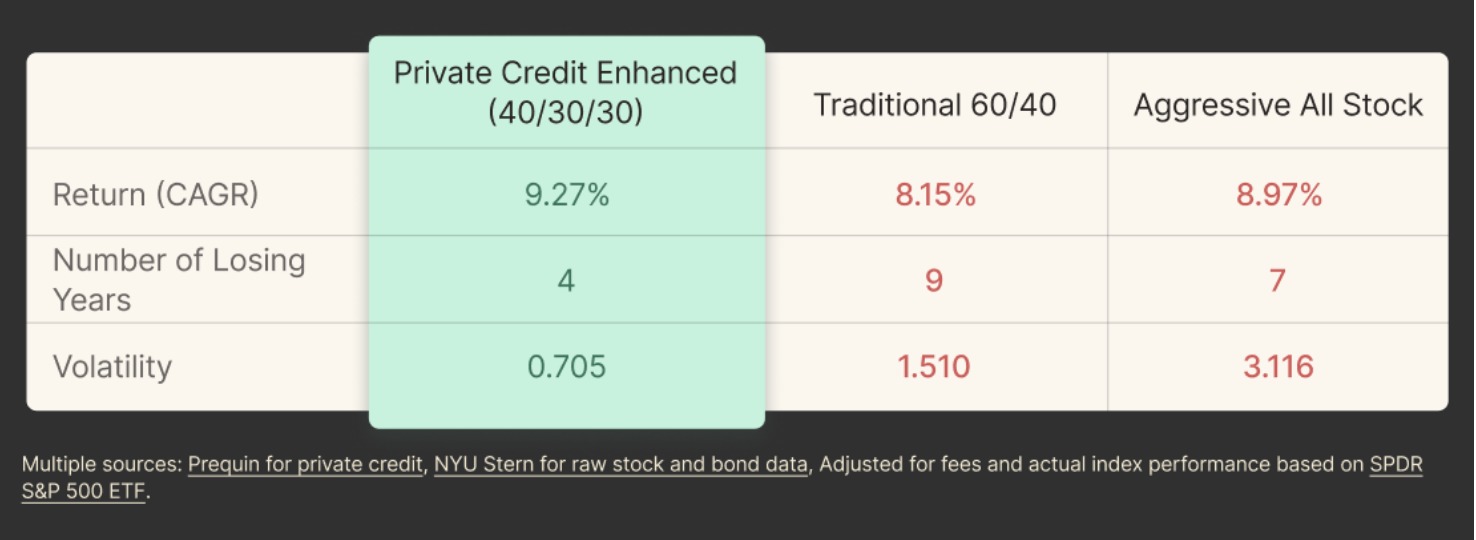

The chart below shows how investment portfolios with private credit exposure have fared vs. traditional 60/40 and aggressive all-stock portfolios over the last 30 years:

Source: NYU Stern, data from Preqin

The higher compound annual growth rate (“CAGR”) and lower volatility for private credit-enhanced portfolios speak volumes, but note the number of losing years as well. That indicates meaningful consistency relative to traditional 60/40 and all stock portfolios.

While past performance is not indicative of future results, we believe private credit is on the upswing, given that macroeconomic and regulatory tailwinds are currently benefiting the sector.

From a macroeconomic perspective, as interest rates increase and general economic sentiment deteriorates, private credit has the ability to outperform vs. stocks and bonds[1]. Amid declining economic conditions, businesses borrow more money to keep their doors open, increasing the demand for private credit and allowing private credit platforms like Heron Finance to access deals with more favorable lending terms.

And from a regulatory perspective, recent proposed changes to banking regulations, such as increasing capital requirements, may make it tougher for banks to lend money. This has already reduced borrowers’ ability to access funding from traditional institutions, encouraging them to turn to private credit instead. As a result, Morgan Stanley predicts that the size of the private credit market will grow from $1.4 trillion in 2023 to $2.3 trillion in 2027[2].

That is why we believe it’s so valuable for accredited investors to gain access to this asset class–many are looking to diversify away from the traditional 60/40 stock/bond portfolio, and this is an opportune moment to consider private credit as a diversification option. In addition, we built Heron Finance as a robo-advisor to make it as easy as possible for clients to participate. Our platform provides access to deals that our credit team sources and monitors, which means all investors have to do is select a strategy and fund their account. We take care of the rest, including periodic re-balancing of investor portfolios, to ensure their allocations match their financial goals and risk tolerance.

To learn more about the private credit asset class, check out: ‘How to Invest in Private Credit’.

Building for the Future

Now that you’re (hopefully) intrigued at the prospect of investing in private credit, let’s discuss why we built our platform using blockchain technology.

Blockchain offers a wealth of advantages to investors on Heron Finance. Here are three primary examples:

1. Reduced Transfer Costs: The fees for sending and receiving money, especially internationally, can be onerous–in some cases reaching 6%! Blockchain enables any amount of money to be transferred anywhere in the world for literally pennies[3]. Reduced transfer costs mean lower fees for you–the investor.

2. Enhanced Transparency: On blockchain, every transaction is anonymized, yet fully public, and cannot be changed by anyone (including us)[4]. Even the code that runs onchain is viewable by anyone[5]. Contrast this with how your traditional financial institution operates–you have limited visibility into the transactions they engage in and just have to trust they have the money they say they do. This often fosters a lack of trust between customer and institution–something we are actively engaged in solving.

3. Greater Interoperability: By layering financial products on top of an interoperable, blockchain-based platform, many different companies can spring up to operate on the same underlying platform, thus fostering more competition, and ultimately creating more value for the user. Just imagine the development of additional lenders on the same underlying platform–in fact, you don’t have to imagine this–it’s already here! Distressed lender Variable Finance recently announced that the company is building on the Goldfinch protocol as well (the same protocol Heron Finance is built on). All sorts of investor benefits can develop from this.

This is the future we are building towards–one where the financial system is global, transparent, interoperable, and open by default. This is why Heron Finance is built on blockchain. To be clear, investors don’t need to be experts in blockchain technology to invest on Heron Finance. We are simply leveraging blockchain to offer enhanced benefits, we are not lending out–or investing in–cryptocurrency.

If you’d like to learn more about the benefits of blockchain technology for Heron Finance investors, click here.

And to learn more about why investors on Heron Finance don’t need experience with crypto to invest on the platform, click here.

Join the Waitlist Today

Institutional investors have long relied on private credit as a cornerstone of their investment portfolios. Unfortunately, most accredited investors have missed out on private credit deals because of the enormous capital commitment required to participate.

Heron Finance is changing that. Our ‘set it and forget it’ robo-advisory approach, coupled with our blockchain-based platform that offers enhanced benefits, make Heron Finance an ideal choice for accredited investors looking to diversify their portfolios away from stocks and bonds.

Click here to join the waitlist.

By joining the waitlist, you will be notified when the product fully launches and you can begin investing funds.

We look forward to being your automated investment platform for private credit!

- The Heron Finance Team

Source: S&P Global (Private credit’s appeal) ↩︎

Source: Investopedia ↩︎

Source: Investopedia ↩︎