Private Credit: 5 Charts All Investors Need to See in 2025

From outperforming returns to lower volatility, private credit as an asset class has proven its stability over the long run compared to other investments. Here’s the data to prove it.

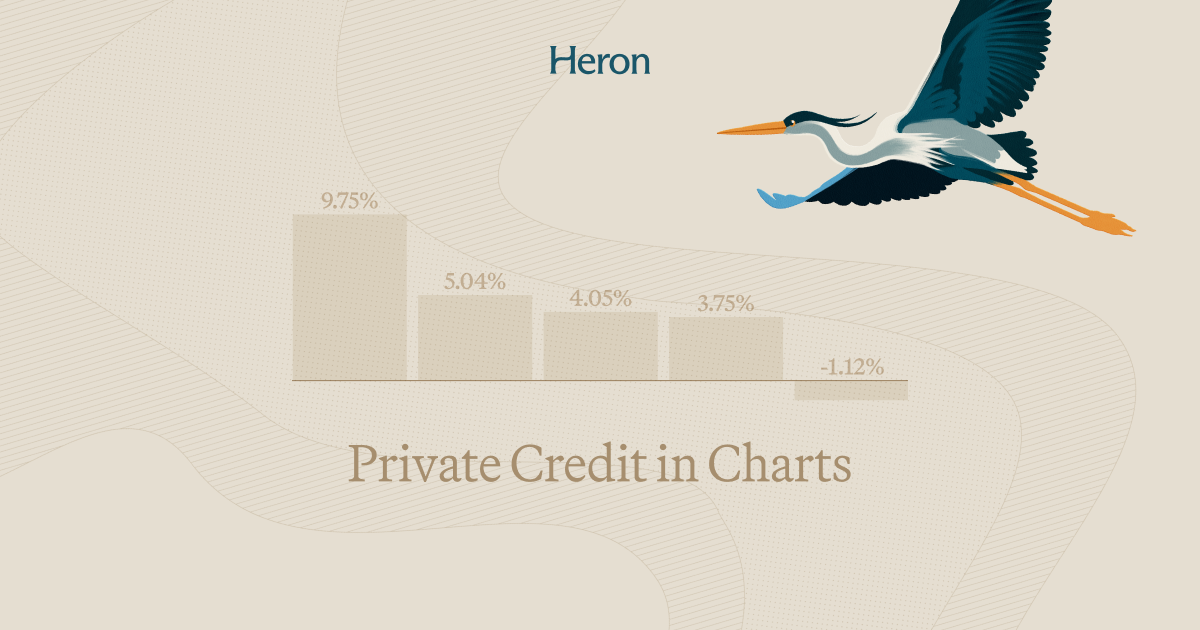

Chart 1: Private credit returns outpace other passive income investments

Over the past 10 years, based on Heron’s internal research, we’ve found that private credit has outperformed four of the main income-generating assets used by investors. In fact, it’s nearly double the returns of real estate, its closest competitor of the group.

Chart 2: Private credit potentially offers high returns and low volatility

Along with annual returns that consistently outperforms other income-generating assets, private credit’s volatility is lower as well. In fact, private credit delivers nearly the same returns as U.S. stocks with 75% less volatility. (Source: T. Rowe Price, 2023)

Chart 3: Private credit makes for a healthy portfolio

By adding a reasonable private credit allocation to a traditional 60/40 stock and bond portfolio, investors can see increased returns and Sharpe ratios. The higher the Sharpe ratio, the more attractive a risk-adjusted return is to investors.

Chart 4: High-quality private credit has less downside risk

When looking back from January 2023 to September 2024, the largest high-yield bond, private credit, and real estate ETFs delivered five or more down months. For investors looking for stable passive income, Heron’s Personalized Private Credit portfolio is the more consistent choice, with zero negative return months.

Chart 5: Know what private credit investment is best for you

There are a handful of ways to invest in private credit. For accredited investors or financial advisors looking to generate passive income from high-quality private credit managers, Heron provides an easy-to-access investment vehicle.

How you can unlock the power of private credit with Heron

The data clearly shows that private credit can play a big role in generating passive income for investors. But actually achieving consistent, high-quality yield from institutional-grade private credit funds takes real work.

Investing in private credit on your own requires you to navigate two difficult problems:

- Complex due diligence: Diversifying across multiple funds requires doing research on dozens of fund managers to ensure you’re finding only the best.

- Challenging fund access: Since the best funds aren’t available through your brokerage, it requires access through an advisor or other means of placement.

Heron solves these problems for you. By leveraging both technology and private credit expertise, we perform the due diligence and provide fund access for you.

Open a Personalized Private Credit portfolio >

With Heron, you get:

- High-quality: Using our proprietary fund scoring model and portfolio technology, we provide you a single investment with exposure to thousands of loans from leading private credit firms like Apollo, Ares, Golub, and more.

- Ease of access: If you invested in funds individually, each fund has you sign their own documents and sends you a different tax form. At Heron, you sign one document and get one tax form, no matter how many funds you’re invested in under the hood.

- Lower fees: Beyond convenience, Heron gives investors access to the lowest share class for all of the funds on our platform, which in most cases saves you 0.85% annually compared to going yourself. It would typically require over $2M of minimum investment across the funds to achieve this.

The end result is one of the most diversified, highest quality private credit offerings on the market — and it’s built for you based on your investment objectives and risk profile.