The Future of Investing in Private Credit Funds: Institutional-Quality Personalized Portfolios

At Heron Finance, we believe the private credit market should be more accessible and more personalized to individual investor preferences. That’s why we created the Personalized Private Credit portfolio for U.S. accredited investors to gain exposure to institutional-quality private credit.

In this article, we dive into how the Personalized Private Credit portfolio fills a gap in the private credit market, our method for selecting private credit managers for our clients’ portfolios, and how we build portfolios creating customized investment opportunities that you can’t get anywhere else.

Table of Contents:

- The Problem: Investing in the Private Credit Market is Mind-Boggling

- The Solution: Private Credit Investing via Automated Personalized Portfolios

- How It Works: Personalized Private Credit Portfolios

- The Future: A Vision for Private Credit Investing

The Problem: Investing in the Private Credit Market is Mind-Boggling

According to the Federal Reserve, historically, private credit has been an asset class invested in by pension funds, insurance companies, family offices, sovereign wealth funds and high net worth individuals. It wasn’t until recent years that all accredited investors could access private credit deals without a significant capital investment.

Technology has changed private credit, but it remains daunting to invest in

Digital technology and new investment vehicles have made it possible for accredited investors—which is now roughly 20% of American households—to have much easier access to private credit.

The creation of publicly traded business development companies (BDCs) a few decades ago along with newer direct-to-consumer platforms has expanded access to private credit. But the asset class still remains challenging to invest in for many retail accredited investors and financial advisors looking for high-quality, diversified yield across private credit managers.

What makes private credit challenging to invest in?

As we said, BDC funds and direct-to-consumer private credit platforms now make it easier to invest in private credit, but we believe three key barriers need to be overcome for the private credit market to be truly accessible to all accredited investors.

1. Knowledge Barrier

Investing in publicly traded BDCs or in one-off private credit deals via direct-to-consumer platforms requires retail investors to conduct thorough research and have enough knowledge to make wise portfolio allocation decisions.

Additionally, ongoing portfolio management and administrative tasks such as taxes require investors to understand and manage multiple private credit assets to maintain a healthy portfolio.

2. Accessibility Barrier

Although access to private credit has increased in recent years, there are still many high-quality non-publicly traded private credit BDCs that are either limited to those investing through a financial advisor or are completely off limits to the average accredited investor and reserved for large institutional investors.

For example, these top tier credit fund managers oversee private funds that require high investment minimums above what a majority of accredited investors can afford.

3. Diversification Barrier

For investors looking to truly diversify their investment in private credit, the current state of the market forces them to manually spread capital across multiple investments, which requires knowledge, access, and time. Investment in a single private credit fund provides exposure to a few hundred loans at most. This may sound diversified, but a single fund uses only one investment strategy overseen by a single fund manager. True diversification requires investing in multiple funds and multiple managers to access the wider private credit market.

Additionally, direct-to-consumer private credit platforms typically only provide exposure to less than a hundred loans in a single industry like real-estate, with some platforms making investors select individual loans for investment. The current structure of private credit offerings make true diversification across thousands of loans and multiple fund managers difficult for investors to efficiently capture.

Historically, private credit opportunities haven’t been “investor-driven”

Additionally, on top of all three of the barriers mentioned above, the majority of private credit investment opportunities are “manager-driven” or “platform-driven” assets, meaning they are built around the goals of the fund or the platform, rather than the objectives and preferences of the individual investor. We think this should change.

At Heron, we’re paving the way for accredited investors to not only access private credit, but have personalized access to exposure from institutional-quality assets across multiple fund managers, portfolio characteristics, and investing styles. Our approach provides exposure to thousands of private credit loans aligned with an investor’s personal risk profile and investment objectives.

The Solution: Private Credit Investing via Automated Personalized Portfolios

As we said before, investing in private credit has become easier in recent years. But whether it’s investing in single manager funds or individual loans, neither option provides private credit market diversification that is truly driven by the personalized needs of an individual investor.

Our team at Heron saw an opportunity.

We built the Personalized Private Credit portfolio

The Personalized Private Credit portfolio gives accredited investors exposure to potentially thousands of loans from diverse industry sectors and across different investment strategies, all in funds from the world’s leading private credit managers. These are managers like Apollo and Ares, featuring personalized exposure to funds like the Ares Strategic Income Fund.

At its core, what sets the Personalized Private Credit portfolio apart from other platforms is the combination of multiple elements:

- Institutional Fund Management: We look for the most established and largest private credit funds as sources of exposure for Heron users. Investors get access to world-class fund managers who collectively oversee approximately $1 trillion in assets under management and each having more than 10 years of experience.

- High-Quality Diversification: Portfolios on Heron have exposure to institutional-quality private credit funds with diversification across all 11 GICS sectors and more than 90% of loans being first lien.

- Ease of Use: Heron’s Personalized Private Credit portfolio is available to all accredited U.S. investors, offering a fully automated digital experience, and the option to submit redemption requests on a quarterly basis subject to liquidity. Plus, every portfolio is personalized to each inventor's risk profile and investment objectives.

Investors on the Heron platform benefit from the track records of the world’s leading fund managers paired with the innovative tech experience of the Heron team. We provide diversified, personalized private credit investing on one platform.

How It Works: Personalized Private Credit Portfolios

To build the Personalized Private Credit portfolio, we’ve combined two key building blocks:

- Selecting private credit funds

- Building Personalized Private Credit portfolios

Selecting the best private credit funds

Heron has a comprehensive framework and proprietary risk scoring model for selecting credit managers. The first three managers that Heron will provide investors with exposure to will be Ares, Golub, and Apollo. Over time, we’ll continue to add more that meet our stringent criteria for quality.

Our framework involves scoring private credit managers across four categories:

1. Team and experience

Strong team and experience, including:

- Years of track record, across multiple market cycles

- In-house capabilities across deal sourcing, structuring, servicing, and risk management

2. Fund track record

Best-in-class performance across credit cycles, with a focus on:

- Consistent total returns, including stable distributions

- Low non-accruals and realized losses

3. Scale

Institutional platforms with significant resources, highlighted by:

- Multi-billion dollar assets under management

- Global network and industry contacts

4. Portfolio quality

Well-constructed, high-quality portfolios with detailed examination of:

- Percent of first-lien loans, and overall composition

- Use of fund-level leverage

- Sector diversification

- Strong net margins

Building Personalized Private Credit portfolios

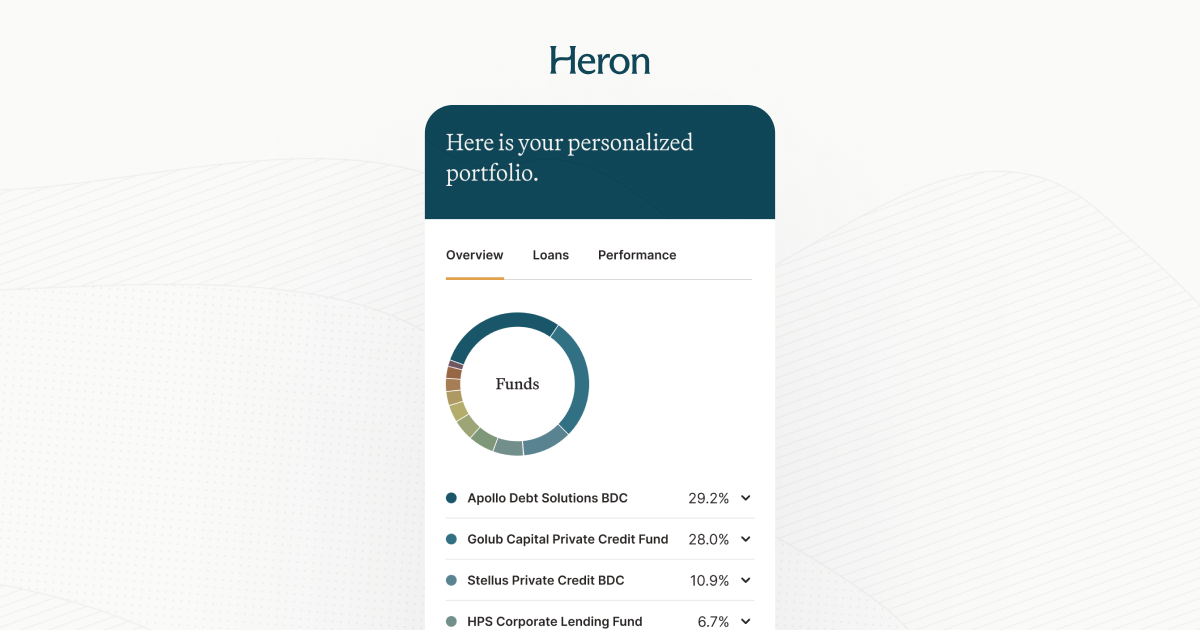

Once we’ve selected private credit funds that meet our standards, we then use the combination of technology and portfolio management to build personalized portfolios for each client.

To start, we collect each investors’ personal preferences around risk and investing objectives to build a portfolio from potentially thousands of loans as a result of our fund selection process. Then, on an ongoing basis, we rebalance investor portfolios as the portfolio value changes, all based on the investor’s risk preferences. Heron users can update their preferences if they’d like to change their investing strategy.

The end result of a Personalized Private Credit portfolio asset allocation is determined by the investor’s preferences, making each portfolio unique to the investor.

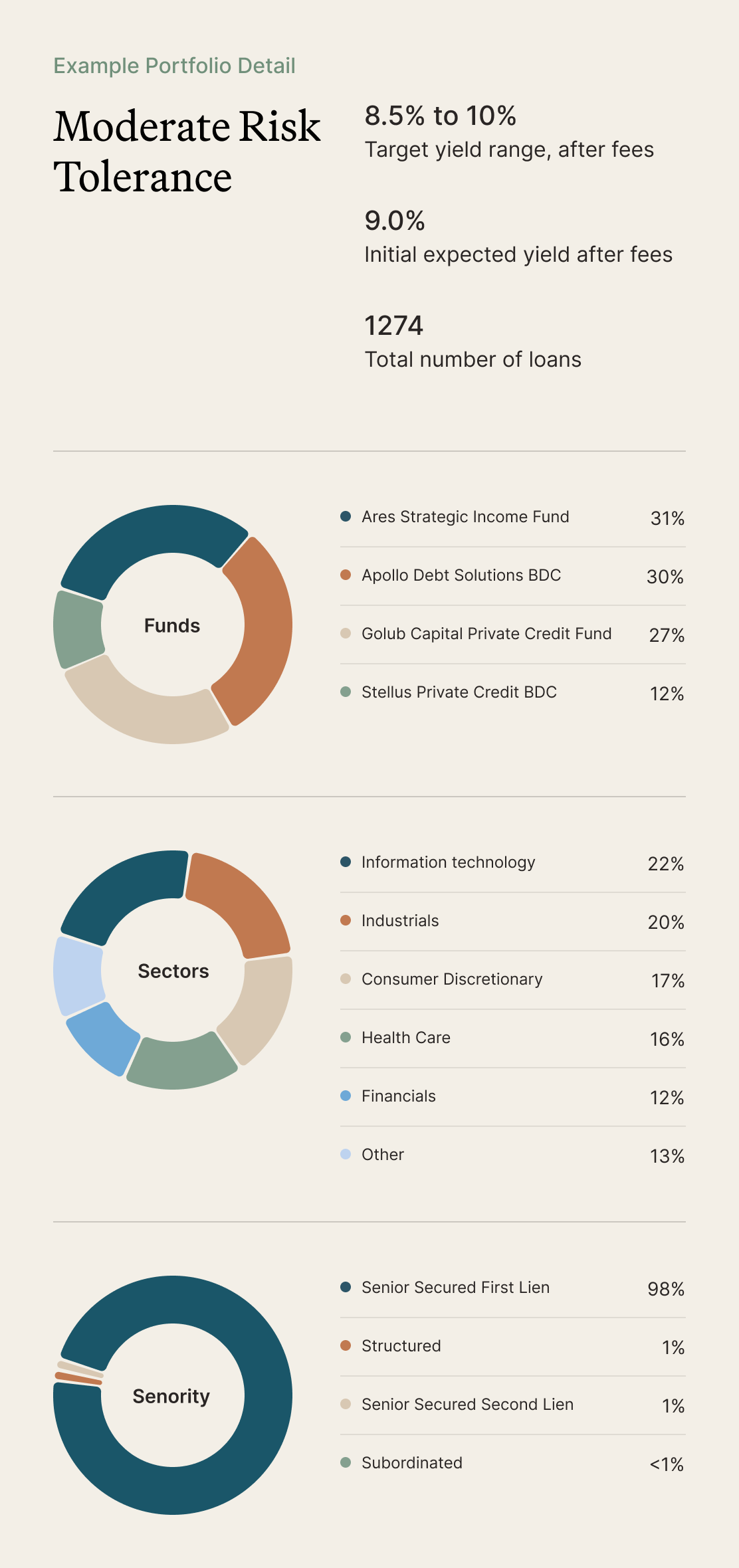

As an example, below is a summary of a Personalized Private Credit portfolio with a moderate risk preference. Rather than providing individual or a small amount of private credit investments, you can see the portfolio provides exposure to over 400 portfolio companies across 11 GICS sectors, with 94% senior secured first lien loans which is the lowest risk level of private credit loan.

The Future: A Vision for Private Credit Investing

At Heron, our mission is to unlock the power of private markets for more investors. With advancements in technology—both in user experience and investment structure—we can open doors to this vital asset class but also deliver a fundamentally better experience for all.

We’re reinventing the private credit investing experience from manager-driven to investor-driven.

Instead of acting as a simple distribution platform for fund managers or a "marketplace" for loans, we’ve created an unprecedented, curated experience that starts with each investor’s preferences. Our platform programmatically builds you a portfolio aligned with your risk profile. You get a bespoke portfolio from Heron, which you can't get anywhere else.

Ready to see how Personalized Private Credit works?

Take a few minutes to open a Personalized Private Credit portfolio and begin unlocking new opportunities for your investment strategy.