What are the Alternatives to Investing in Stocks?

Stocks are notoriously volatile, which has many investors looking for ways to diversify away from the stock market. This article explores alternative assets that are available to accredited investors.

Over the decade from 2012-2022, the stock market rose consistently (minus some temporary downward blips).[1] Yet 2022’s 19% drop in the S&P 500 and 33% drop in the NASDAQ, along with 2023’s tepid reversal, illustrate the inherent volatility in stocks (as do historical recessions such as the 2000 Dot-Com bubble burst and The Great Recession of 2008).[2]

Given the recent turmoil, investors have been reconsidering their strategies and searching for opportunities beyond public markets.

In this article, we’ll explain the alternatives to stocks, how stock performance compares to the performance of alternative investments, and how accredited investors can access alternative investments like private credit (an investment once reserved solely for the ultra-wealthy).

Key Highlights

- Stocks are easy to access and have traditionally offered consistent growth, and in some cases, regular income through dividends

- Stocks are the foundation of most portfolios, so alternatives that differ across a range of characteristics offer the strongest diversification

- Private credit is an alternative asset that is not as highly correlated to public markets as other investment options, and which has consistently experienced positive returns in years when the stock market has lost ground

What are the Alternatives to Stocks?

One of the benefits of investing in stocks is that they typically offer the potential for higher capital appreciation, instant liquidity, and (in some cases) provide regular dividend income.

Of course, such investments also carry risks, as stocks are extremely volatile and often fluctuate based on market sentiment rather than underlying valuation metrics.

If you’re looking for an alternative to stocks, you’ll want to consider choosing an asset class that’s largely differentiated. This way, the performance of the two will be less correlated, and you will achieve the benefits of portfolio diversification.

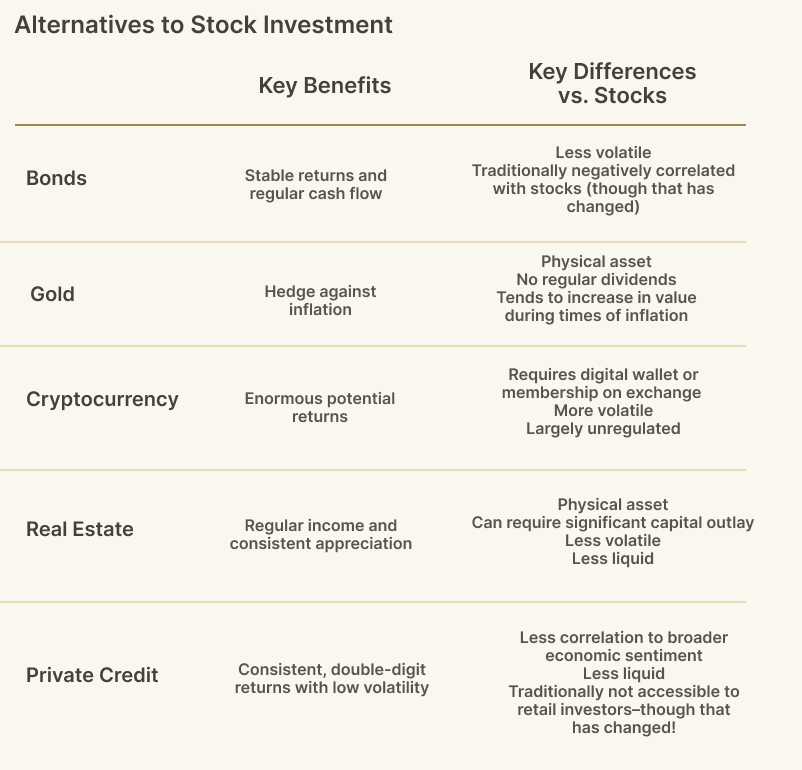

The below chart highlights some prominent alternatives to stock investment:

Due to the increased volatility in the stock and bond markets, alternative investments have gained steam as an attractive diversification option. Many institutions are recommending allocating a portion of their clients’ portfolio to alternative investments, including the largest private asset manager in the world, BlackRock, which suggests allocating up to 20% to alternatives.[3]

Fortunately for investors, there is one alternative that stands out when it comes to the potential for strong, consistent returns, lower volatility, and a lack of correlation with public markets.

Private Credit as an Alternative to Stocks

As noted in the chart above, private credit offers the potential for better returns with lower volatility than the stock market.

The return profile is dependent on the specific private credit fund or platform one uses to invest. Yet platforms such as Heron Finance, which builds diversified portfolios of private credit deals for accredited investors, target double-digit returns that seek to outperform the historical performance of the S&P 500 (which produces a roughly 10% annualized return). Of course, target returns are just that–they are not a guarantee of future results or performance.

And in terms of volatility, there is really no competition. As mentioned previously, the S&P 500 dropped 19% in 2022, and the NASDAQ plummeted 33%. In contrast, the median private credit fund manager has never experienced a down year–in other words, the private credit sector has always produced a positive annual return.[4]

How is this possible?

Well, private credit is relatively insulated from the broader economic climate. When interest rates rise, private credit tends to outperform, given that private credit loans are often floating rate and rise in tandem with rising interest rates. While it’s true that default rates may also rise as interest rates rise–thus negatively impacting private credit funds–that is not necessarily a given. At time of this writing (June, 2024), default rates have not risen meaningfully in the United States, even though interest rates have soared.[5] Also, businesses feeling the pinch will look to lenders for additional capital, providing private credit funds with greater demand for their services.

In fact, many experts are citing current market conditions as a ‘golden moment’ for private credit, prompting many institutions to pour money into the sector.[6]

Investing in Private Credit with Heron Finance

The chief drawback of private credit as an asset class has long been its lack of accessibility. Typically, only institutions and high net worth individuals have been able to invest in private credit funds.

But digital platforms like Heron Finance are changing the game. Now, accredited investors can gain access to private credit investments, and achieve stock-like returns with bond-like consistency–just like the ultra-wealthy have been doing for years.

Heron Finance is available to accredited investors only, but the platform makes the verification process easy. Here is a brief article which outlines the 4-step process for verifying your accreditation status through Heron Finance.

If you are an accredited investor and you’d like to start investing in private credit, simply click the button below to begin setting up your Heron Finance account.