What are uncorrelated assets and why do investors care?

One of the primary benefits of investing in alternative assets is their lack of correlation with public markets. This article explores that benefit in greater detail, as well as the risks associated with these types of assets.

Get a diversified private markets portfolio built for market volatility.

As investors explore alternative investments, they’ll inevitably come across the term ‘uncorrelated asset.’

An uncorrelated asset is an investment that has little or no correlation to traditional asset classes like stocks and bonds. This means its price movements are largely independent of broader market fluctuations.

In this article, we’ll explore what uncorrelated assets are, their benefits and risks to an overall portfolio, and how digital platforms like Heron Finance are making it easier for individual investors to access these niche investment types.

Key Highlights

- Uncorrelated assets have a low or negative correlation coefficient when compared to stocks and bonds. A correlation coefficient close to 0 indicates little relationship between the assets' returns.[1]

- Common examples of uncorrelated asset classes include private equity, private credit, venture capital, real estate, precious metals, collectibles, music royalties, and more.

- Including uncorrelated assets in a portfolio can help reduce overall portfolio volatility and risk, as they provide diversification benefits by not moving in tandem with traditional assets, yet many uncorrelated investments are relatively illiquid, opaque, and carry higher individual risks compared to public markets.

What are Uncorrelated Assets?

As mentioned above, the term ‘uncorrelated asset’ implies an asset that has little or no correlation with public markets (publicly-traded stocks and bonds). In other words, uncorrelated assets have price movements that are independent of these more traditional asset classes.

In order to determine an asset’s correlation with public markets, investors use what’s known as a ‘correlation coefficient.’ This mathematical term is denoted by the letter ‘r’, and is calculated using data points, means and standard deviations.

The correlation coefficient can be a range anywhere from -1 to 1. An ‘r’ of -1 implies a perfectly negative correlation, and an ‘r’ of 1 implies a perfectly positive correlation, with an ‘r’ of 0 implying no correlation whatsoever.[2]

This understanding is critical, because one must not confuse two assets with a -1 correlation coefficient as being ‘less correlated’ than two assets with a 0 correlation. Technically, the assets with 0 correlation are totally uncorrelated–that is to say, their price movements are entirely independent of one another. Assets with a -1 correlation are negatively (or inversely correlated), meaning that as one asset moves up in price, the other moves down in price to the same degree. Hence, there is a correlation here–it is just a negative one.

It's important to note that correlations can shift over time, especially during extreme market events. That is why it’s important to consistently monitor the correlation between the various asset types in one’s portfolio–to ensure that positive, negative, and uncorrelated assets have not changed their correlations to one another.

The Benefits and Risks of Investing in Uncorrelated Assets

Investing in uncorrelated assets aims to protect capital during market downturns, as they are theoretically insulated from the same systemic risks impacting stocks and bonds. However, it’s worth noting that in extreme market events like the 2008 financial crisis, even previously uncorrelated assets can become correlated as investors sell indiscriminately to raise cash.

The main goal of including uncorrelated assets in a portfolio is to enhance risk-adjusted returns by reducing overall portfolio volatility. By combining assets with diverse performance patterns and low or negative correlations, investors can reduce their exposure to any single risk factor and potentially enhance their portfolio's long-term risk-adjusted returns.

Below are some benefits of including uncorrelated assets in an investment portfolio:

- Diversification benefits: When the assets in a portfolio have low or negative correlation to one another, their price movements are either independent or inversely related. As one asset class declines, another may rise, offsetting losses and smoothing out overall portfolio returns.

- Reduced portfolio variance: Portfolio variance (a measure of volatility) is a weighted average of the individual asset variances and their covariances (correlations).[3] Including uncorrelated assets with low or negative covariances reduces the overall portfolio variance.

- Resilience through market downturns: Uncorrelated assets often have exposure to different risk factors or drivers of returns. Therefore, during market downturns, uncorrelated assets can help dampen the severity of portfolio drawdowns compared to a concentrated portfolio.

- Improved risk-adjusted returns: By reducing overall portfolio volatility, investors can potentially achieve higher risk-adjusted returns over the long-term.

Of course, investing in uncorrelated assets isn’t a panacea. Below are some key risks associated with investing in these asset types:

- Illiquidity risk: Many uncorrelated assets like real estate, private equity, collectibles etc. are relatively illiquid investments with limited ability to sell quickly. There may be few established markets for buying/selling, and investments may need to be held for extended periods before realizing returns.

- Due diligence challenges: For some uncorrelated asset classes, there is often limited information and transparency compared to public markets. This makes it harder to conduct thorough due diligence and properly assess the risks before investing.

- High risk of losses: Many uncorrelated investments carry higher individual risks compared to stocks and bonds. For example, most startup investments through venture capital tend to fail and lose capital for investors.

- Valuation difficulties: Valuing certain uncorrelated assets can be challenging due to lack of market pricing, raising concerns about accurate performance reporting.

- Potential for correlations to increase: As noted earlier, the correlations of certain assets to traditional markets can increase during extreme market events as investors indiscriminately sell to raise cash. In other words, correlations can and do change over time, so the correlation coefficient must be constantly monitored.

Examples of Uncorrelated Assets

At this point you might be wondering, what are these assets that investors are using to diversify their portfolios? Below are some prominent examples of uncorrelated assets:

- Real Estate: Real estate has historically shown low correlation to stocks and bonds, as its returns are driven by different factors like rental income and property values. Investors can gain exposure through direct property ownership, REITs, or real estate crowdfunding platforms.[4]

- Precious Metals (Gold, Silver): Precious metals tend to have low or negative correlation to traditional asset classes and can act as a hedge against market volatility and inflation.[5]

- Fine Art and Collectibles: Assets like fine art, wine, classic cars, and other collectibles have their own niche markets and pricing dynamics, making them largely uncorrelated to stocks and bonds.

- Private Equity/Venture Capital: Investing in private companies and startups through private equity or venture capital funds provides exposure to an asset class with returns that are not directly tied to public markets.

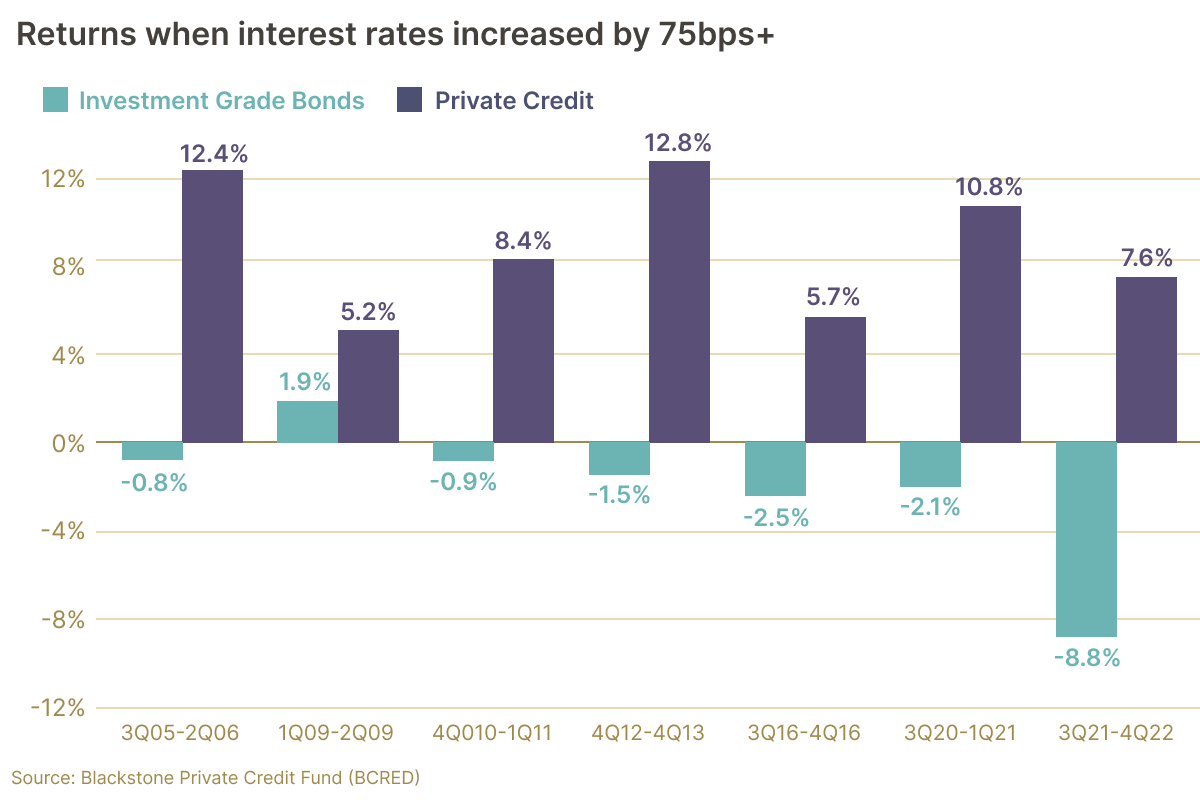

- Private Credit: Investments in non-bank lending helps diversify portfolios away from the fluctuations of traditional stocks and bonds. This is especially true during times of interest rate hikes, as private credit tends to outperform stocks and bonds during such periods.[6]

- Litigation Finance: Providing capital to plaintiffs involved in lawsuits in exchange for a share of any settlement or award. The returns are based on legal outcomes rather than market movements.

- Music Royalties: Investing in the rights to music royalty streams from popular artists and songs, which generate income based on music consumption rather than market factors.

To learn how to invest in potentially uncorrelated assets, see Heron's "How it works" page.

How Digital Platforms Make it Easier for Individual Investors to Invest in Uncorrelated Assets

Investing in stocks and bonds is relatively easy–set up and fund a brokerage or retirement account, and voila!

Investing in uncorrelated assets is not as straightforward, especially to the average investor. These markets tend to be less liquid, making them more opaque and more difficult to access than the publicly-traded markets.

That said, digital platforms are paving the way for accredited investors to access uncorrelated assets and diversify their portfolios away from stocks and bonds.

At Heron Finance, we build you a diversified portfolio of private market funds. Open an account to see the funds available on Heron.

Private markets have historically been uncorrelated with broader markets, even rising during times of high interest rates (when stocks tend to fall).

For example, the below chart illustrates private credit's inverse correlation with bonds:

Source: Blackstone - Oct. 4, 2022

One more chart shows how the median private credit manager has performed in down years for the S&P, further illustrating the diversification benefits of including private credit in one’s overall investment portfolio.

Source: data from Preqin - Jan 2024

The above charts display private credit’s historical impact as a portfolio diversifier. While past performance is no indication of future results, many investors are including private credit in their portfolios to smooth out volatility should the stock and bond markets tumble.

If you’re an accredited investor, explore private market investing with Heron.

Source: Investopedia - Nov 29, 2023 ↩︎

Source: Wall St. Mojo - Apr 10, 2024 ↩︎

Source; Franklin Templeton - Jan 2023 ↩︎

Source: Blackstone - Nov 16, 2023 ↩︎

Get a diversified private markets portfolio built for market volatility.