What’s Behind the Meteoric Rise of Private Credit?

Private credit's growth trajectory is sharply upward. Find out what is causing this massive growth spurt, and why now is a 'golden moment' for the asset class.

Once considered an afterthought in banking and institutional circles, private credit has grown from $875 billion of assets under management in 2020 into a nearly $2 trillion industry today.[1] Even major institutions like banks and global private equity funds are launching private credit vehicles of their own.[2]

So how did this little-known sector of the market evolve so quickly? And what makes the current moment so promising that institutions are piling in at a record clip?

The answers are threefold: Regulatory changes, macroeconomic conditions and digital innovation.

In this article, we’ll help you understand the rise of private credit, how regulatory changes fueled its wide scale adoption, and how the dual tailwinds of higher-for-longer interest rates and digital disruption are likely ushering us into a golden era for the asset class.

Key Takeaways

- Regulatory changes post-Great Financial Crisis spurred banks to lend less, which opened the door for private credit funds to fill the gap, kicking off a 15-year growth run.

- Today, the macroeconomic tailwind of higher interest rates is supporting the continued growth of private credit, which outperforms most other asset classes during times of rising interest rates

- Digital disruption is enabling individual accredited investors to gain access to private credit deals for the first time–opening up wider access to this burgeoning asset class

What’s Bad for Banks is Good for Non-Banks

Private credit launched in earnest in the 1980s, when insurance companies began lending to businesses that banks either could not or would not lend to.[3] Yet (counterintuitively) it took a massive financial crisis to really get the ball rolling.

After the near-meltdown of the global economy in 2008, Congress passed regulation which imposed stricter lending protocols on large banks–most notably, the Basel III Accords of 2010–which forced such banks to hold significantly more liquid assets (i.e., cash) at the expense of traditional lending activity.[4]

The resulting impact has been that national and multinational banks must maintain lower leverage ratios, meaning they must maintain larger cash reserves-and as a result, can issue fewer loans.[5]

As the below chart indicates, loans as a percent of FDIC-Insured bank assets fell from 60% to 50%, and cash holdings increased from 5% to 15% for US banks. This may not sound like much, but that’s more than a trillion dollar shift.

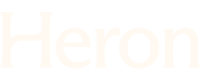

Of course, the need for lending did not disappear. Capitalism 101 tells us that when a gap in the market exists, some enterprising individuals will look to fill it. As the below chart illustrates, that’s exactly what private credit fund managers have been doing as banks have retrenched from making loans.

Source: Brookfield Oaktree

As you can see, non-banks - specifically, private credit investors - began capturing market share well before 2008. Yet post-2008 is when the gap widened the most. And to be clear, we’re not talking about banks simply dropping the riskiest investments from their portfolios. Instead, banks mostly focused on standard loan types (e.g., government-backed home mortgages). Customized loans became more challenging, as bank regulations made due diligence and underwriting costly and time-consuming.

Given these new regulations, it doesn’t make much sense for banks to issue loans to smaller, growth-stage businesses, where total returns for the bank are relatively small. That means banks are letting creditworthy deals fall by the wayside.

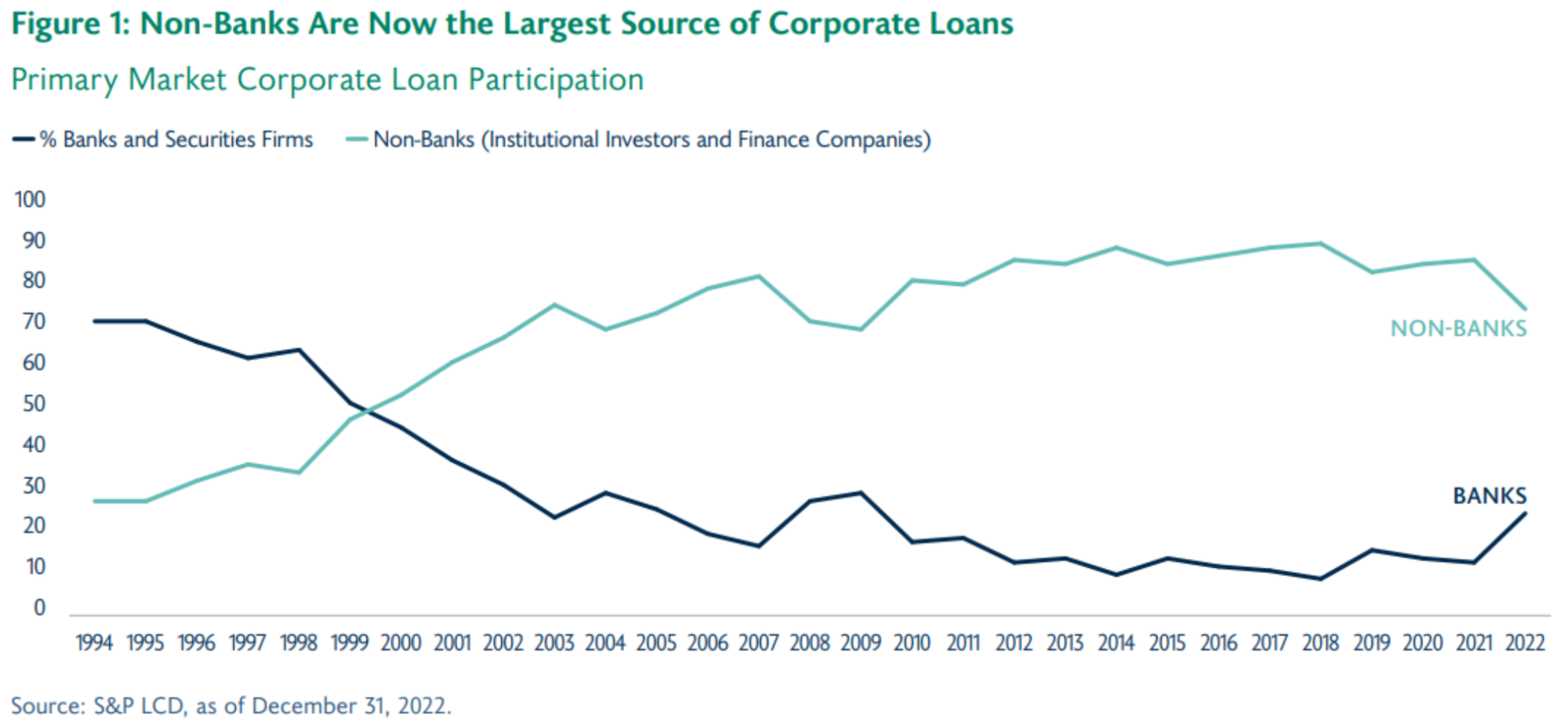

Source: OECD

As the chart above illustrates, small and mid-size enterprises (SMEs)–represented by the orange line–have similar default rates as larger businesses–represented by the blue line. This implies that lending to SMEs is no riskier–from a capital preservation standpoint–than lending to large corporations.

The above point might seem counterintuitive–lending to SMEs isn’t as risky as lending to large corporations? Don’t SMEs have a higher likelihood of defaulting on their loans?

Well yes, they do. But since private credit lenders typically specialize in a specific sector–one in which the team has both subject matter expertise and a strong network–they tend to select borrowers who are less likely to default. As Goldman Sachs points out: “Private credit has historically maintained loss ratios [default rates] that are lower than those of high-yield fixed income instruments [e.g. bonds issued by large banks].”[6]

It also doesn’t hurt that growth-stage companies in these sectors have limited options for capital, which means private credit lenders can obtain attractive interest rates and maintain significant leverage when negotiating protective risk terms.[7] That gives private credit funds a meaningful edge when it comes to mitigating downside risk.

The Numbers Tell the Story:

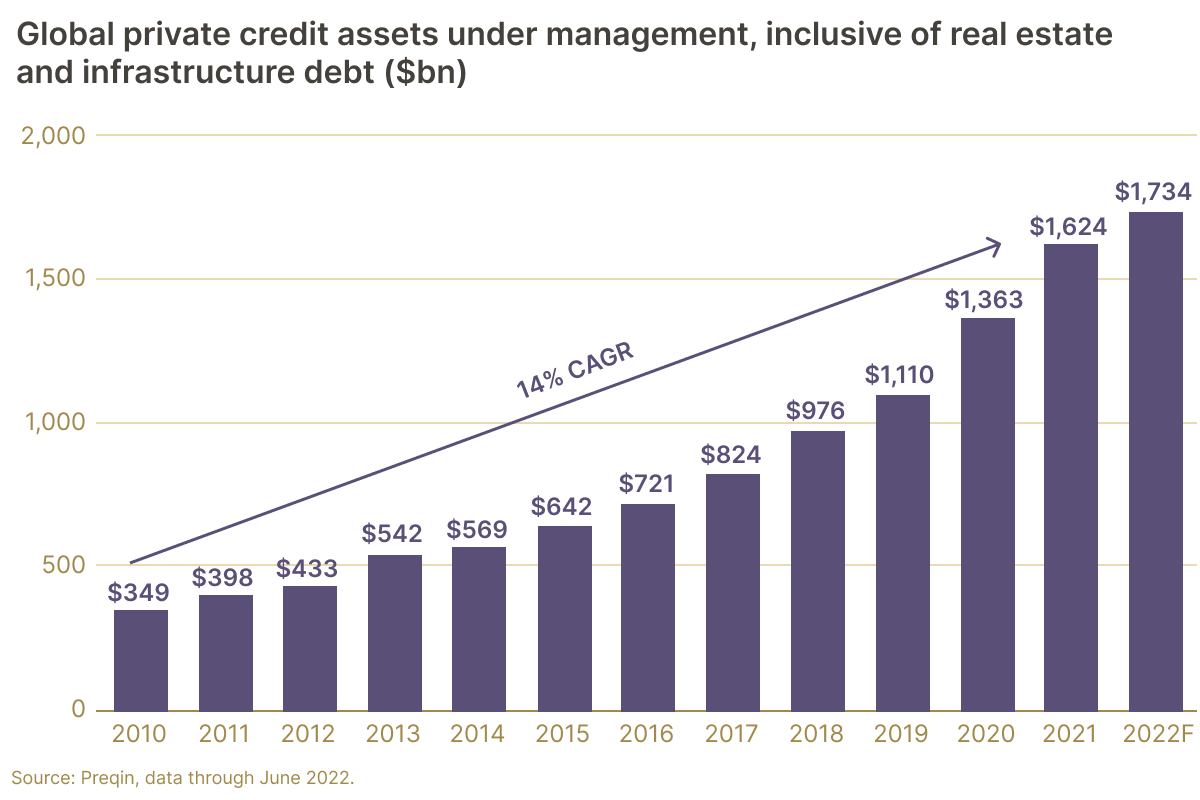

- The pullback from large banks has spawned exponential growth in the private credit sector over the past decade–from $400 million in AUM in 2013, to $1.4 trillion today[8]

- Regulations have been proposed in Congress in the wake of the recent Silicon Valley Bank collapse, which seek to regulate regional banks in the same way that large banks are regulated.[9] With regionals pulling back their lending as well, Morgan Stanley predicts private credit AUM will increase by 64% over the next four years, from $1.4 trillion today to $2.3 trillion in 2027[10]

- One harbinger of that growth: Private credit deal sizes keep getting bigger. Finastra’s $5.3 billion restructuring in 2023 set an all-time record[11]

A Golden Era for Private Credit

The data shows that private credit is on the upswing, and the tailwind thus far has been the industry’s ability to invest in growing sectors that are overlooked by traditional banks. Yet market conditions are ripe for private credit’s continued ascension within the broader financial services landscape.

And by ‘market conditions’ we mean those pesky interest rates that keep going up, coupled with digital innovation that is expanding access to this asset class.

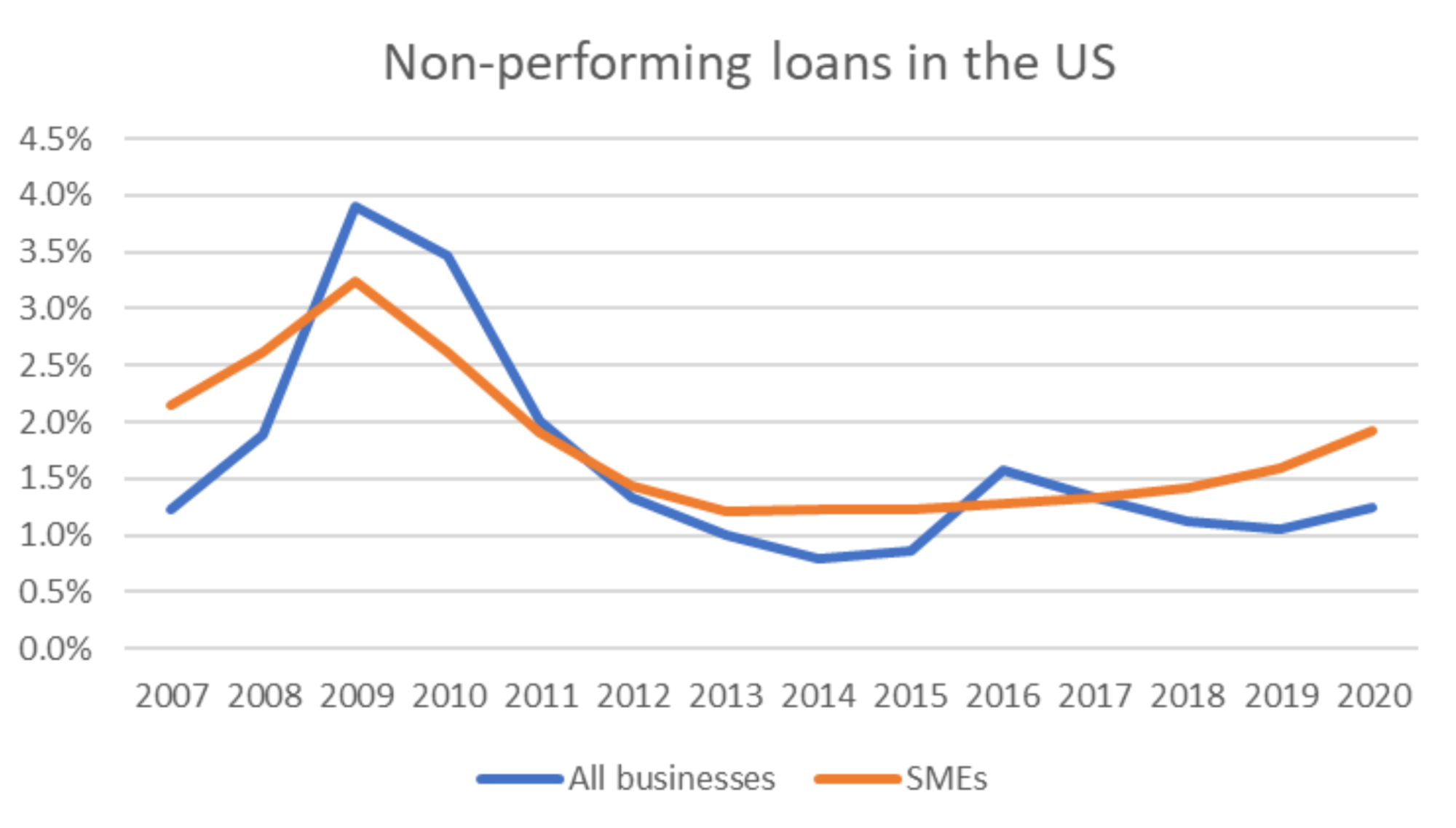

On the first point, you might think that–akin to many asset classes–private credit suffers when interest rates are high. Well, as the chart below indicates, the opposite has been actually true:

Source: Blackstone

Rising rates “suck out” dollars from the economy as investors move into “safe” bets like government bonds. This broad lack of cash is a boon for private credit funds, as companies still need capital to grow. That means private credit lenders can choose among some of the best-in-class companies, charge higher interest spreads, and require stricter risk controls.

To quote Churchill Asset Management’s co-head of senior lending and head of capital markets: “The current credit vintage, which sports lower leverage, tighter structures, and wider pricing [ie. higher rates], is significantly more investor-friendly than anything over the last decade.”[12]

That’s an ‘inside baseball’ way of saying that private credit is benefitting from current market conditions, including high interest rates and a widening gap in the supply/demand curve for credit.

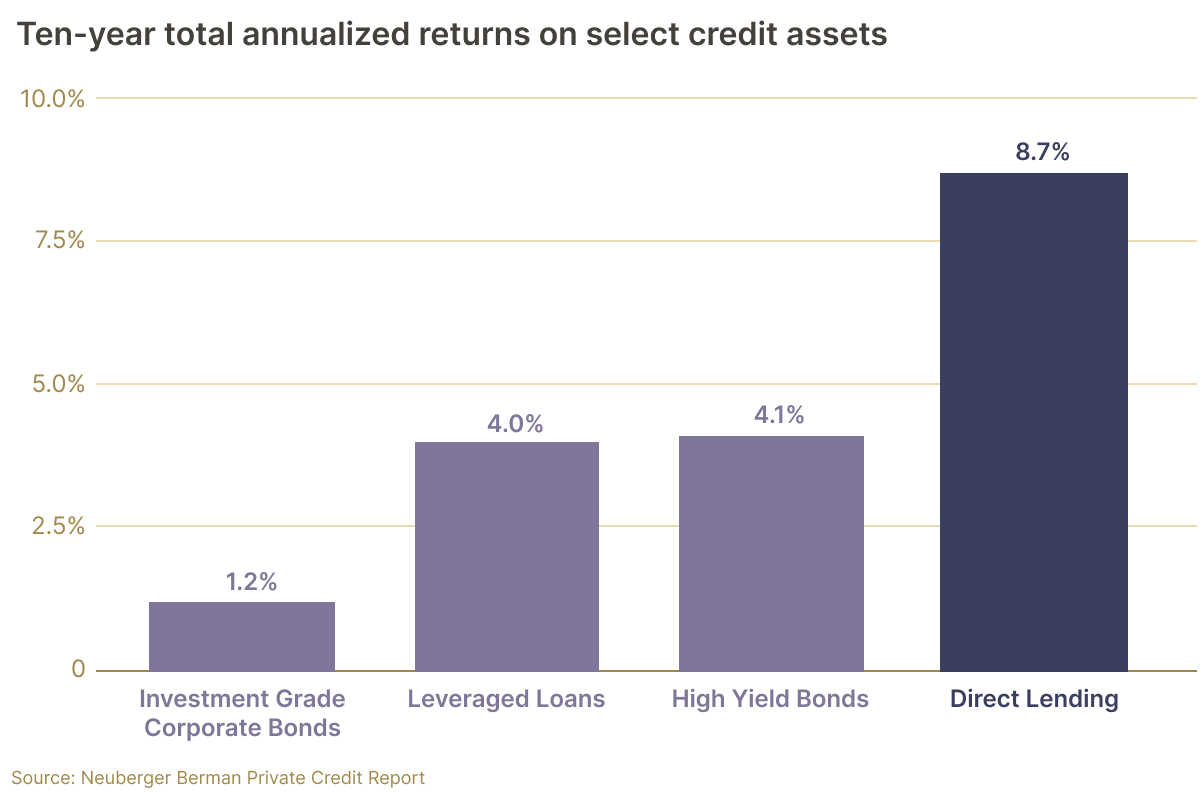

And the proof is in the numbers. Direct lending–which makes up the majority of private credit deals–has outperformed bonds and leveraged loans over the past ten years:

Source: Neuberger Berman

Meanwhile, the compound annual growth rate (CAGR) for private credit AUM has been steadily increasing, as you can see from this chart:

Source: data from Preqin

In short, the private credit sector is growing larger by the year, and the 10-year return profile dwarfs that of other major lending investments.

Lights, Camera, Digital Disruption!

If regulatory changes set the stage, and macroeconomic conditions (high interest rates) are earning the rave reviews, then digital disruption is helping sell more tickets.

You see, for most of private credit’s history, this asset class has been the purview of large institutions and the ultra-wealthy–those who could afford the exorbitant minimum investment requirements (typically $250,000 and up).

Digital platforms like Heron Finance are changing that.

Heron Finance allows accredited investors (who were previously shut out of private credit deals due to their inability to meet the minimum requirement) to diversify their portfolios with an alternative asset that institutions have been investing in for decades.

If traditional private credit can be thought of as a Broadway play with high ticket prices that few can afford, Heron Finance is helping transform the industry into a digital experience that many more can afford.

For that reason, digital disruption can be thought of as that third tailwind–only just now emerging as part of private credit’s growth story. As platforms like Heron Finance gain in popularity, digital disruption is likely to act as a force multiplier, attracting investors into an asset class they might otherwise not have participated in.

This can help fuel private credit’s continued upward momentum, and help grow this industry for many years to come.