Get an automated private market investing portfolio diversified across thousands of global assets to hedge against volatility and inflation.

Automated portfolios with white-glove support.

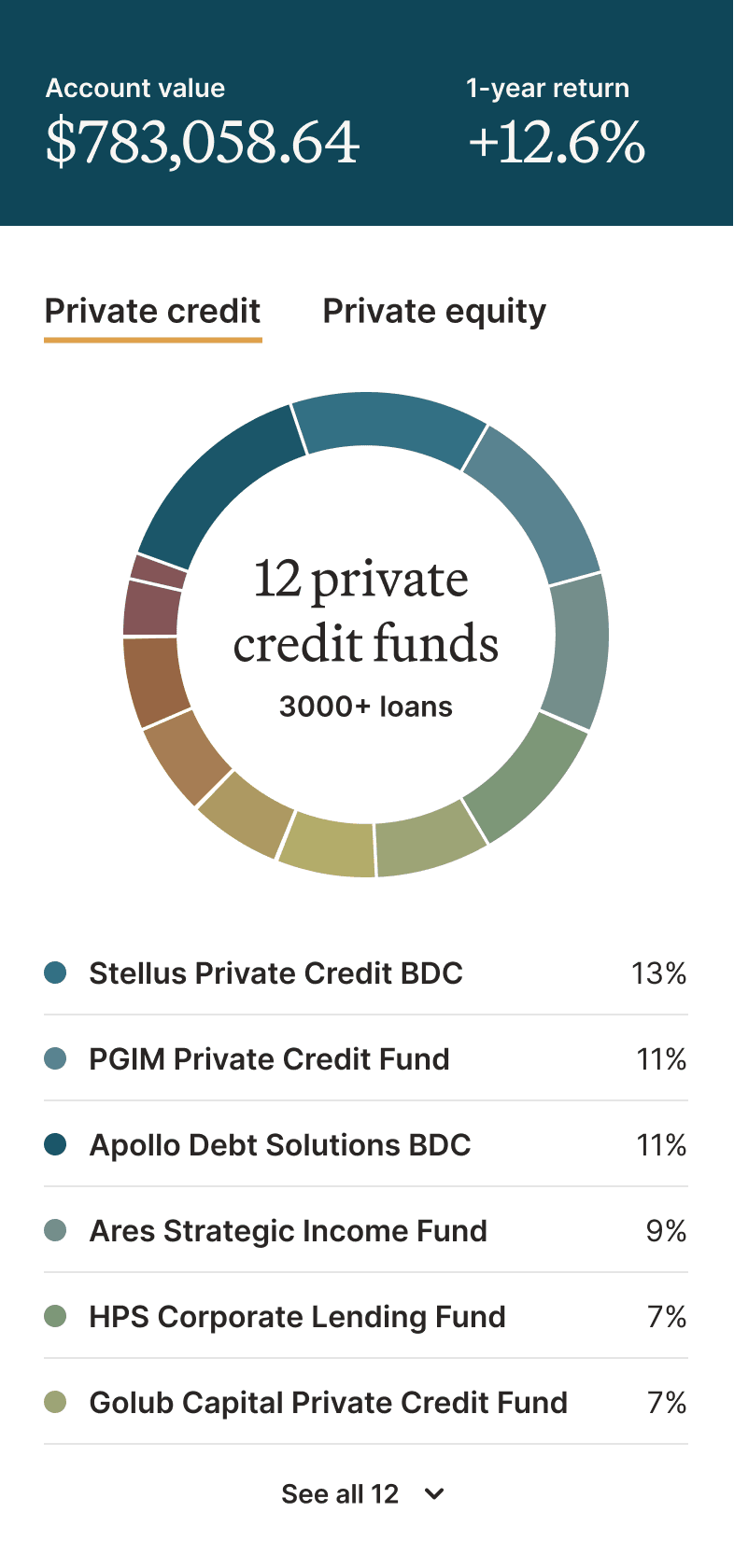

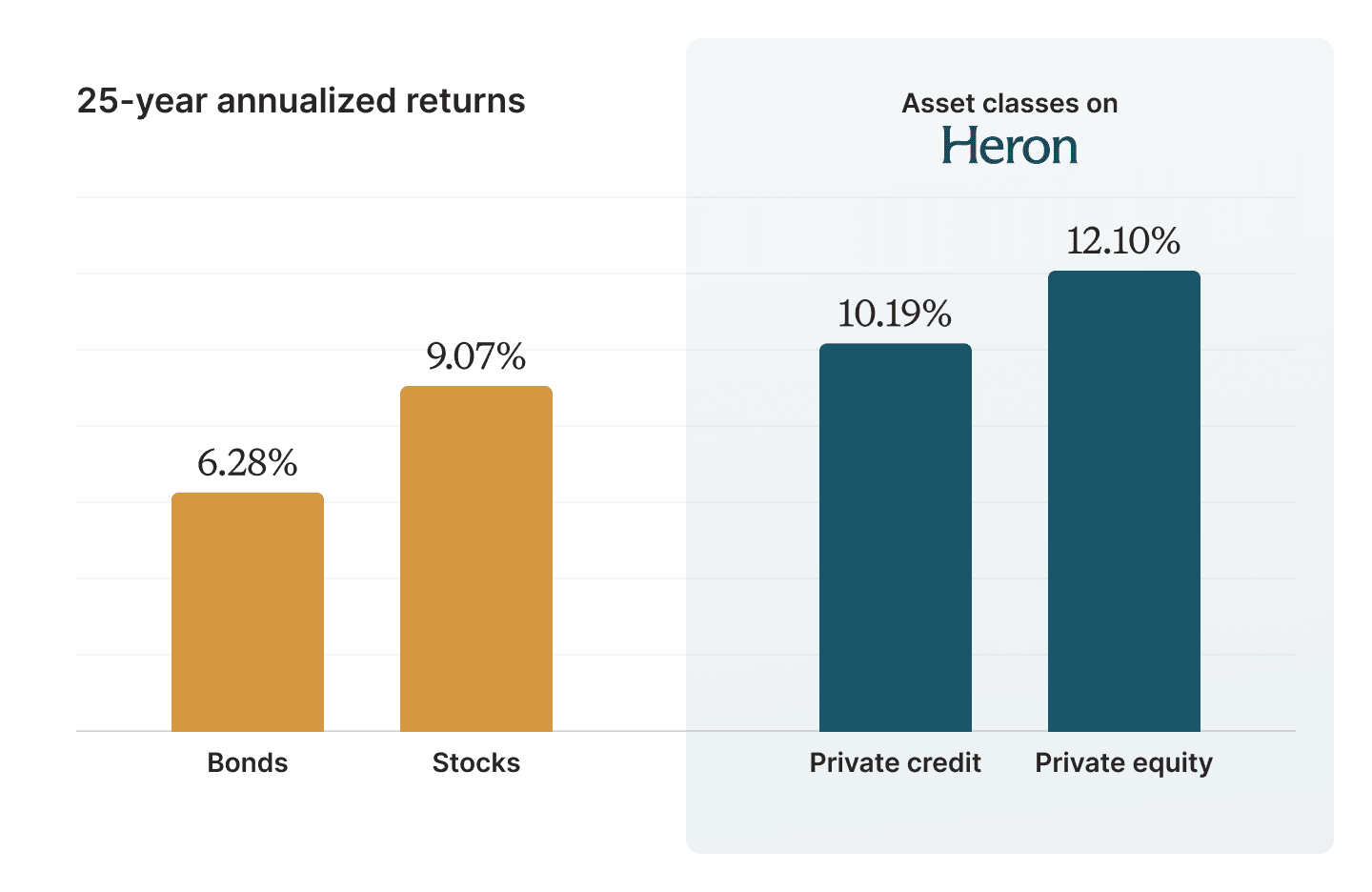

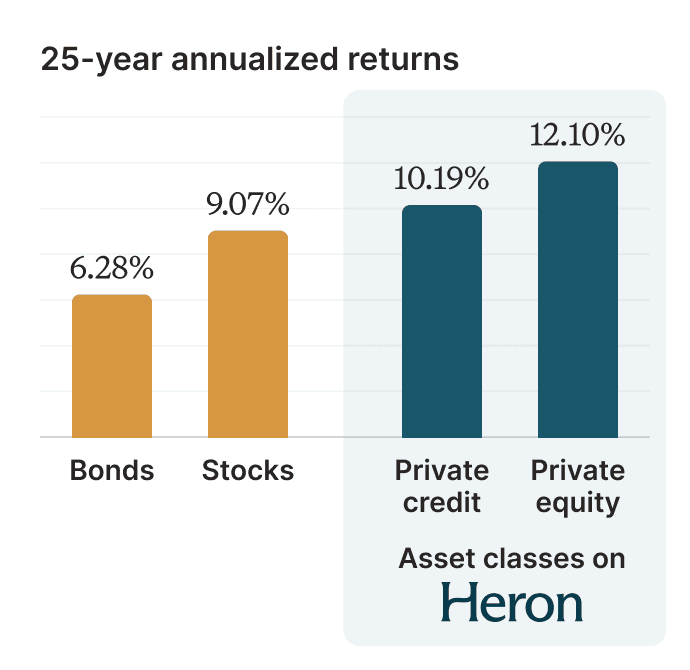

Heron helps you diversify beyond stocks and bonds through private markets.

Multiple asset classes to diversify your private market exposure.

Access to established private market funds.

Invest with confidence.

Trusted by investors like you

Your questions answered.

To start, we don't plan to go out of business! We are backed by large institutional investors, generating revenue, and maintaining an ample runway. As any business should, we maintain a continuity plan.

In the highly unlikely event that we did wind down the business, your money is still safe. At a high level, here's what you need to know and how it would wind down:

- All LP shares of funds are held in a separate, bankruptcy-remote legal entity from the one that we use to run our day-to-day operations. Second, Heron Finance works with a qualified custodian, Inspira, that custodies said LP shares.

- In the event that Heron Finance's operating entity were to shut down, we would submit redemption requests to all of the funds.

- Then that separate holding entity and Inspira would work to identify a backup service provider that could manage the redemptions and work to facilitate the return of your capital.

Anyone automatically qualifies as an “accredited investor” if they meet just one of the following criteria:

- Income: Individual income of $200,000, or joint (with a spouse or partner) income of $300,000 for the two prior years, with the same anticipated in the current year

- Net Worth: Individual or combined (with a spouse or partner) net worth of $1 million or greater, excluding your primary residence

- Exam: A Series 7, 65, or 82 in good standing

You can verify your status as an accredited investor as a part of our sign-up process. The documents you need will depend on the method of verification. You only need to verify via one of the following:

- Income verification: Connect your payroll provider, or upload W-2s, K-1s, 1099s, paystubs, or tax returns to verify your income

- Net worth verification: Bank statements, brokerage statements, securities holdings statements, certificates of deposit, tax assessments, or appraisal reports (Note: when you use the net worth verification, we pull a “soft” credit report that will not impact your credit score.)

- 3rd party letter: A letter from an attorney or accountant testifying that you are accredited

To learn more about how to become accredited, see our article: 4 Easy Steps to Becoming an Accredited Investor.

Learn more

Get your private market portfolio recommendation.

White-glove support at every step.

Charts, images, and other visual materials are for illustrative purposes only and should not be considered individualized investment advice. The strategies shown may not be suitable for all investors.

The information on this website does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information contained on this website is a recommendation to invest in any securities or a recommendation of any interest in any investment offered by Warbler Labs, Inc. or any of its subsidiaries (collectively, “Warbler”).

Any financial forecasts or financial returns, whether in the form of interest or appreciation displayed on this website are for illustrative purposes only and are not a guarantee of future results. Private credit investments are subject to credit, liquidity, and interest rate risk. In the event of any default by a borrower, you will bear a risk of loss of principal and accrued interest on such loan, which could have a material adverse effect on your investment. A borrower may default for a variety of reasons, including non-payment of principal or interest, as well as breaches of contractual covenants. Credit risks associated with the investments include (among others): (i) the possibility that earnings of a borrower may be insufficient to meet its debt service obligations; (ii) a borrower's assets declining in value; and (iii) the declining creditworthiness, default, and potential for insolvency of a borrower during periods of rising interest rates and economic downturn.

Any investment target return presented here is intended for informational purposes only and does not guarantee future performance or results. This model assumes no variability, including no loan defaults, fluctuations in interest rate, customer withdrawal requests, late payments, or penalties, and our management fees have remained unchanged throughout this projection. Please be aware that all investment involves inherent risks, and past performance is not indicative of future outcomes. Customers are advised to consult their own legal and tax advisers regarding their specific circumstances and needs. We do not accept any liability for any loss or damage arising from the use of this information or for any actions taken based on this information without seeking professional advice.

Private equity investments involve a high degree of risk, including the potential loss of the entire investment, illiquidity, long holding periods, limited transparency, and sensitivity to economic and market conditions. Diversification does not ensure a profit or protect against loss, and past performance is not indicative of future results. Comparisons to individual private funds, public markets, institutional portfolios, or other benchmarks are provided for illustrative purposes only. These may not represent a direct comparison, may rely on data reported by third-party managers, and may reflect differing methodologies, time periods, or investment universes. Data from underlying fund managers may be subject to reporting lag, estimation, or revision.

No communication by Heron or any of its affiliates through this website should be construed or is intended to be investment, tax, financial, accounting, or legal advice. Heron Advisory, Inc., d.b.a. Heron Finance is an SEC-registered investment advisor (RIA). Such registration should in no way imply that the SEC has endorsed the entities, products or services discussed herein.