At Heron Finance, our deal sourcing process involves a multi-pronged approach:

- Filtering potential deals through our finely-tuned investment criteria

- Working with other lenders that have a track record of investing in the private credit space

- Monitoring our investments to mitigate risk as much as possible

In this article, we’ll walk you through that process in an effort to peel back the curtain on the filtering mechanisms that a prospective deal is put through before it reaches your Heron Finance portfolio.

1. Private credit lenders should clearly define their investment criteria so they know which deal types to target. This can change over time, but once determined, should act as a filter for any potential deal flow

2. Heron Finance’s deal sourcing currently takes the form of syndication partnership. In the near future, we may also introduce direct originations

3. When it comes to lending, ‘trust but verify’ is a worthwhile mantra. We have faith in our borrowers, but we always verify their progress through monthly conversations and regular reporting requirements

Step 1: Investment Criteria

If you’ve ever hired for a job opening, you’ll understand the rationale behind establishing firm investment criteria. Typically, an employer will require ‘must haves’ when hiring for a role–attributes like specific skills, years of experience, a track record of having produced certain value, etc. This helps filter through the inevitable deluge of responses. Investment criteria acts in much the same way–enabling us to filter out borrowers who don’t meet our minimum basic requirements, and focus on those who might be a strong fit.

Below are some examples of how Heron Finance defines our investment criteria:

- Borrowers must either be profitable or hold assets that can be used to make principal and interest payments

- Borrowers must have at least 18 months of a strong operational track record

- All of our investments must be secured by assets of the borrower

- Our investments must have an average life of less than 18 months, and may contain call options that repay our principal within 18 months

We analyze risk factors with an aim to protect our clients’ principal investment, and also limit our average lifetime exposure on both a deal-by-deal and portfolio basis. The focus here is to provide better liquidity compared to traditional credit funds, where little or no liquidity is available for investors until several years after the investment is made.

We also ensure that underlying borrowers have a track record of at least 18 months of operations. In our opinion, this is enough time to establish confidence that the assets are reliable, while still enabling us to target early-stage borrowers who may not be able to secure a bank loan, and are therefore willing to pay us higher interest rates (our target net APY is 11-16%).

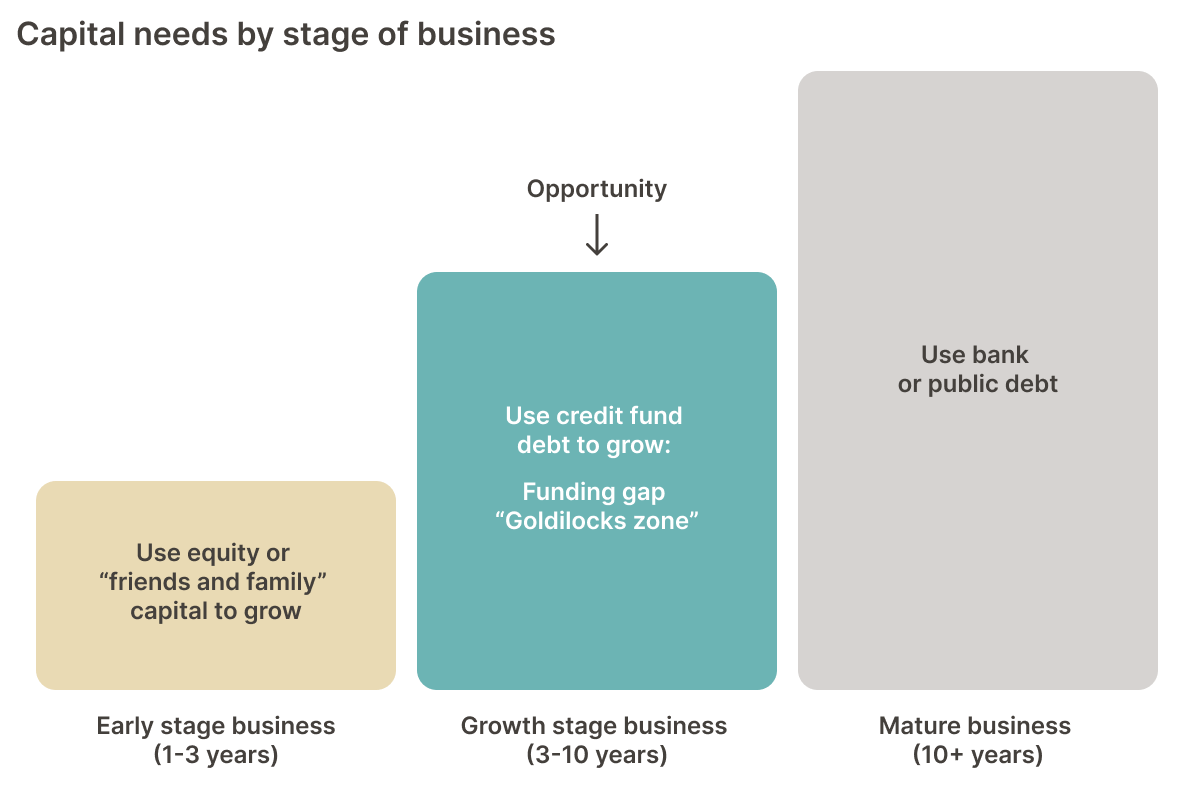

As the chart below illustrates, when a business reaches its adolescent years (in this case, the 3-10 year range), it can become more difficult for that business to obtain a loan, as the business has often outgrown VC and angel funding, yet is typically not mature enough to obtain debt financing from established players in the market such as commercial banks.

At Heron Finance, we target underlying borrowers in the above ‘Goldilocks zone’ (we’re willing to accept a business that is at a slightly earlier stage, hence the minimum 18 months of track record).

Step 2: Deal Selection

Once our investment criteria is clearly defined, we can begin securing deal flow. Currently, Heron Finance achieves this by working with syndication partners. In this approach–also known as acquiring a secondary position–we purchase interests in deals from established credit funds and private credit lenders. When acquiring a secondary position, we diligence the underlying borrower as well as the lender who sells us the participation interest. We must ensure that the credit provider we are partnering with has an established track record and maintains a stellar reputation in terms of how they manage their borrower and maintain syndicate partner relationships.

Broadly speaking, our goal is to diversify our overall portfolio with a range of deal types, thus systematically reducing risk. By investing in deals that span industries, geographic regions and credit structures, we are able to provide our investors with diversified exposure to the private credit asset class.

The team at Heron Finance will soon expand our deal sourcing to include direct originations. In this approach, our credit team will source deals through our various networks. We will connect with the borrowers directly and review their company financials, business model, customer breakdown, industry and competitor landscape, executive and leadership team, and other important information.

Once deals are selected by a member of our credit team, they make their way to our investment committee. At Heron Finance, each and every deal we finance must pass through a rigorous investment committee process where each deal is presented to a team of credit experts for consideration. You can learn more about our investment committee by visiting our About page.

Our deal standards mean we end up rejecting a large percentage of deals that are reviewed by our investment committee. And remember, all deals brought to our investment committee have already been filtered through the investment criteria, which excludes certain deals at the outset. That means that every deal on the Heron Finance platform is filtered through a series of control mechanisms–so by the time that you, the investor, commit your hard-earned dollars into a deal, that deal has been through the ringer in terms of our credit team’s review and due diligence process.

Step 3: Deal Monitoring

Once the structure is in place and agreed upon by both parties, each countersigns a credit agreement and Heron Finance transfers our balance sheet capital into the syndicate partner’s account. This is the point where you, the investor, might see the deal appear in your Heron Finance portfolio (depending on which investment strategy you have selected).

We then obtain a participation interest with the syndicate partner, which simply means we purchase a position in the loan. We distribute that position to investors on the Heron Finance platform based on their investment preferences.

Of course, the deal is far from over–we still need to make sure that our borrower repays the loan!

Post-investment monitoring is part of every lender’s remit. We monitor our borrowers on a monthly basis (through their monthly reporting) to get a sense of how the business is performing and any hiccups that might be taking place along the way. We also review the business’ financials to ensure the borrower is not about to breach a covenant.

A common question is what happens in the event of a covenant breach or default? In these instances, our first approach is to negotiate with the borrower (or in the case of a syndication, with the syndicate partner). Our goal here is to recoup our capital investment plus the interest we are owed on our portion of the loan. So we look to see how we can work with borrowers during times of distress (we may consider lengthening the payback period, or allowing them to pay interest only for several months). There are numerous arrows in our quiver when it comes to the negotiation process.

If the borrower is unable to meet their repayment obligations, then a default occurs. In the event of a default, we follow the legal documentation which specifies how we–and any other lenders–assume control of the collateral.

Upon assuming control, our aim is to liquidate the collateral in a manner that helps recoup as much investor principal as possible, as quickly as possible. We consider the liquidation process to be a last-ditch effort, which means we look to exhaust all other avenues before embarking on this path.

In Conclusion

There’s no getting around the fact that when you lend money, you assume risk. The key to success lies in mitigating that risk as much as possible, while still offering the potential for healthy returns to investors.

Defining investment criteria, selecting the right deals and diligently monitoring your investments are our three pillars of success. We’re proud to be working hard every single day to bring you the most investment-worthy private credit deals we can find.