Monthly insights: Time to tune out Jamie Dimon (October 2025)

This month, we look at why Jamie Dimon's comments shouldn’t be viewed as an alarm bell for private credit (let alone systemic risk). If anything, it is more reflective of challenges in the bank loan market.

Monthly Insights #7, October 2025

In this issue:

- Current events: Time to tune out Jamie Dimon

- Fund facts: $100 million

- Quote of the month: The bigger picture

Current events: Time to tune out Jamie Dimon

If you’ve followed private credit news in the past few weeks, you may have seen Jamie Dimon in the headlines again.

In response to two high-profile bankruptcies which impacted banks and private credit funds, on JPMorgan’s October earnings call Jamie Dimon shared, “When you see one cockroach, there are probably more. And so everyone should be forewarned on this one.”

But as we’ve said in the past, the news headlines don’t tell the full story.

On that same earnings call, JPMorgan CFO Jeremy Barnum said:

“A lot of the private credit actors are large, very sophisticated, very good at credit underwriting. So, I don't think you're supposed to jump to the conclusion that there are necessarily lower standards there or a huge systemic problem.”

Seeing the bigger picture beyond Jamie Dimon

Remember, Jamie Dimon grabs headlines because he’s Jamie Dimon. There’s more nuance to markets, just like his CFO, Mr Barnum, shared.

“Some investors are extrapolating a bit too much about situations that are esoteric and not systemic,” says David Havens, senior credit analyst at Bloomberg Intelligence in an article from The Financial Times.

One important point that gets missed is that the two bankruptcies that Mr. Dimon referenced are not actually traditional private credit deals:

- First Brands, an auto parts supplier, got financing primarily in the bank loan market (i.e., public credit).

- Tricolor, a subprime autolender, got financing from the asset backed securities market (i.e., also public credit).

And so, this shouldn’t be viewed as an alarm bell for private credit (let alone systemic risk). If anything, it is more reflective of challenges in the bank loan market.

The ratings agencies seem to agree:

- “The rapid descent by auto parts supplier First Brands Group from ‘B+’ to default does not reflect elevated risk for the traditional direct lending market,” said Fitch Ratings in a statement. They went on to say, “Fitch views this as a private placement of a broadly syndicated loan rather than a traditional “private credit” instrument.”

- “First Brands, if it was rated by us, would not have been considered in any way, shape, or form a private credit transaction,” said Bill Cox, chief rating officer at Kroll Bond Rating Agency (KBRA), which tracks thousands of private credit loans. “Its main debt was full-on public, broadly syndicated loans.”

How does private credit compare to broadly syndicated loans?

The broadly syndicated loan (BSL) market, which First Brands accessed, involves banks arranging large corporate loan facilities and syndicating them to a broad group of institutional investors. BSLs are rated and trade in an active secondary market.

Private credit loans, by contrast, are directly originated through mostly-bilateral transactions, privately negotiated, and held by one lender or a small lender group with limited or no secondary market liquidity.

Historically, private credit has experienced an average annual loss rate of 0.9%, compared to 2.0% for BSL, as reported by Morningstar.

Proskauer recently reported a private credit default rate of only 1.84% for Q3 2025, slightly up from 1.76% in Q2 2025.

Commenting on these trends, which are generally in line with historical averages, Stephen A. Boyko, partner and co-founder of Proskauer’s Private Credit Group, said:

“The overall picture remains one of strength and resilience. The market continues to mature, and this quarter’s findings underscore the importance of proactive risk management and thoughtful structuring in navigating today’s credit environment.”

What does it mean for Heron investors?

First, when we read the headlines, we always need to make sure we understand the nuance before making investment decisions. And second, in a broad category like private credit, “selective diversification” matters.

While private (and public) companies can go bankrupt, a few “bad apples” highlight why heavy diversification—and wisely selecting private credit managers you trust—is essential to mitigate undue risk.

That’s why at Heron, we look at thousands of data points to help build portfolios.

The portfolios we build for clients include 3,000+ first-lien loans sourced from more than a dozen private credit managers, diversified across multiple industry sectors and covering the private credit spectrum from lower middle market to upper middle market. This “selective diversification” provides a buffer from some of the risky parts of the private credit market or in the case that a few companies within a portfolio are struggling.

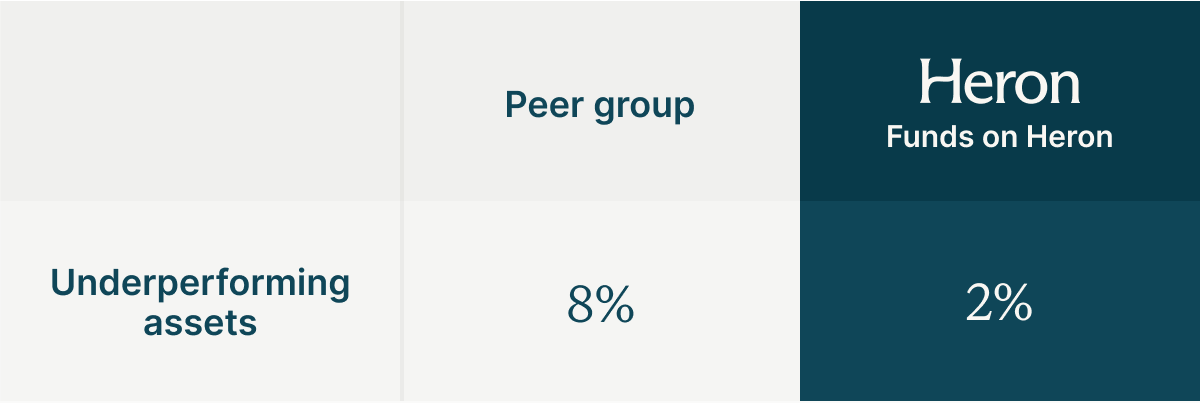

We see the results of our approach in the low level of underperforming assets within the funds in Heron portfolios compared to our peer group.

To put it simply, the average private credit fund on Heron has a higher share of loans performing at or above expectations than the broader private credit market, which helps lower default and loss risk.*

While there are risks in private credit investing, our approach is designed to mitigate those risks for you. And regardless of what Jamie Dimon is saying in the news headlines, our goal is to construct Heron portfolios that deliver a more attractive risk-adjusted return than investors can get anywhere else.

As always, thanks for reading,

Heron Chief Credit Officer

Heron fund facts

Fact: $100 million is the approximate amount of profit generated by an average borrower in the funds on Heron each year.

Why that matters: Many investors think of private credit as lending into risky, small and medium sized businesses, but the fact is that the average corporate borrower in the private credit world today tends to be an established, profitable business with hundreds of million dollars in annual revenue. Learn about the misconceptions of private credit.

Quote of the month

“I am realistic, I see the bigger picture and I recognize who I am teammates with.”

– George Russell, Formula 1 Driver

Get a diversified portfolio built for market volatility.

*Dataset source: SEC filings for June 2025. Dataset includes over 60 of the largest U.S. private credit funds, which are actively managed by firms that collectively manage in excess of $1 trillion in private credit assets across their funds and accounts. Percentages shown as medians. Funds on Heron includes funds being made available through Heron as of August 2025. Peer group includes all funds in the dataset but excludes Heron funds. Notes: Underperforming Assets shown as percentage of assets considered by the underlying credit managers as performing below their own expectations, and not necessarily indicative of potential defaults.